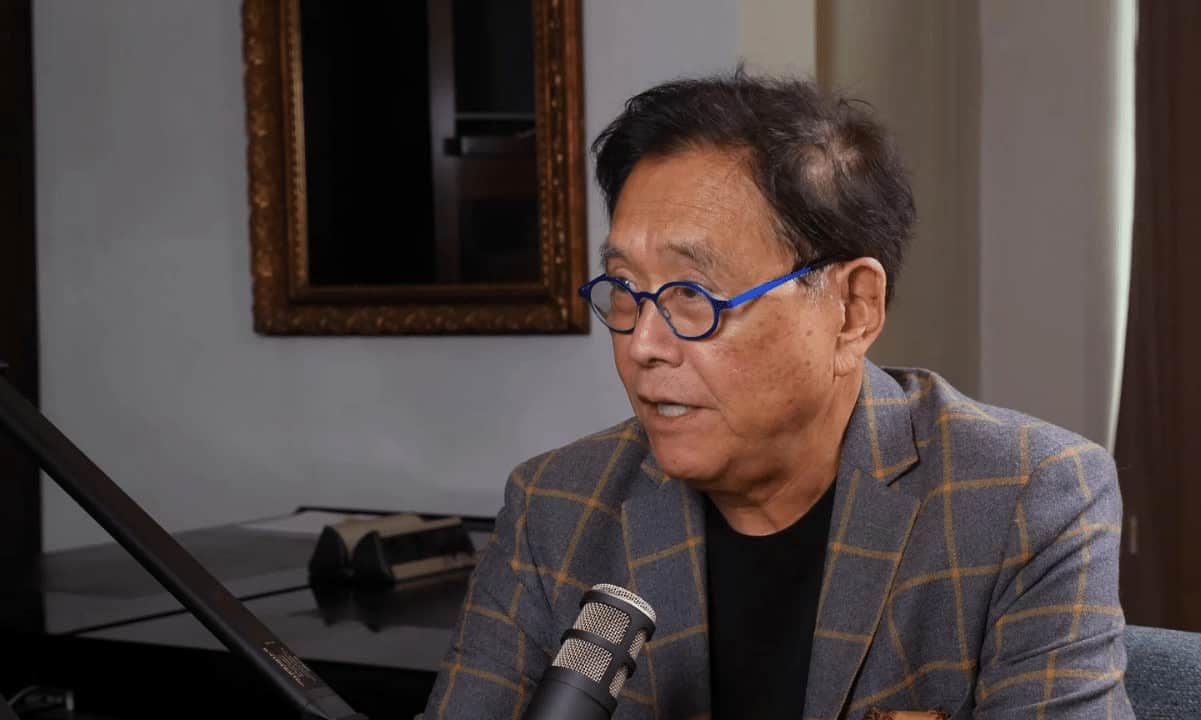

4 Quotes from ‘Rich Dad Poor Dad’ for Bitcoin Investors in 2025

On April 20, Kiyosaki shared on X his belief that “BITCOIN is $84k today. Strongly believe Bitcoin will reach $180k to $200k in 2025.” Just five days later, Bitcoin’s value exceeded $93,600.

On April 18, the author of “Rich Dad, Poor Dad” expressed his expectation that Bitcoin’s value could soar to $1 million. His predictions raised concerns about the dollar’s purchasing power:

“I strongly believe, by 2035, that one Bitcoin will be over $1 million. Gold will be $30k and silver $3,000 a coin.”

Kiyosaki remarked in a detailed update on X, “Those who listened to my warnings are thriving, yet I worry for those who did not.” He cautioned that “the coming Great Depression will leave millions impoverished… while a few proactive individuals may find significant wealth and freedom.”

Challenging Economic Conditions and Resourceful Bitcoin Investors

Kiyosaki’s perspective aligns with other voices warning of a looming economic crisis. Federal Reserve Chair Jerome Powell indicated in April that the U.S. might soon face a period characterized by stagnant growth and inflation.

He is not alone in forecasting Bitcoin hitting the $1 million mark. His timeline is considered conservative compared to Twitter co-founder Jack Dorsey, who anticipates this price point by 2030, as suggested last May.

Kiyosaki strongly believes in the potential for Bitcoin to achieve significantly higher values in the next five to ten years. Here’s how his classic investment principles apply to Bitcoin.

1. Kiyosaki on Wealth vs. Income

“The affluent prioritize their assets while everyone else focuses on their earnings.”

In his bestseller about personal finance and wealth creation, Kiyosaki highlights the distinction between wealth and income. He states that income requires considerable time and effort to generate, while wealth automates income.

This implies that even individuals with high salaries can experience financial strain if they spend excessively and incur high-interest debts to maintain their lifestyle.

A recent survey by PYMNTS and the Lending Club revealed that around 50% of Americans earning six figures are living paycheck to paycheck.

Moreover, the Philadelphia Federal Reserve reported that overdue credit card payments and minimum repayments are at their highest since 2012.

People with these spending habits are countering economic trends, unlike Bitcoin investors who accumulate wealth by saving and investing.

Living beyond one’s means predicates a challenging future for the comfort of the present, unlike frugal savers who prioritize tougher choices now for greater rewards down the line.

2. Investing Insights from ‘Rich Dad, Poor Dad’

“Understand the difference between assets and liabilities, and prioritize acquiring assets. An asset generates income, while a liability incurs expenses.”

Kiyosaki distinguishes clearly between assets and liabilities within individual or household finances, arguing that homes should not automatically be seen as assets due to their maintenance costs.

During the U.S. housing market surge before the 2008 crisis, the prevailing belief was that purchasing a home was a wise investment, with values expected to rise indefinitely.

However, following the wave of defaults in 2007, housing prices plummeted. Bitcoin emerged thereafter, carving a new niche in finance based on settlement rather than credit.

Rather than incurring debt for immediate consumption, Bitcoin allows individuals to reap future gains by being frugal today and investing savings in BTC.

If it continues to rise in value fueled by its limited supply and global demand, it will remain a true asset, contrasting with liabilities like mortgages and credit debts.

3. Financial Literacy and Bitcoin

“Financial ignorance, both in math and language, is the root of financial difficulties.”

Kiyosaki emphasizes in his work that the education system and government largely fail to prepare Americans with fundamental financial knowledge and investing skills.

He observes that many people are unaware of the drawbacks associated with borrowing money, often prioritizing interest payments over saving and investing.

This lack of understanding not only keeps many Americans from engaging with Bitcoin and cryptocurrencies but also inhibits their ability to save money across the board.

A recent retirement survey found that half of Generation X has not planned for retirement at all.

Within the cryptocurrency community, the mantra “Do your own research” is prevalent, especially among Bitcoin enthusiasts who urge “Do the math.”

Learning about investing and financial mathematics can counteract the allure of instant gratification and foster healthier financial behaviors.

Household Finances, Consumer Debt, and Bitcoin

“A person can be highly educated and successful yet still lack financial literacy. Many financial issues stem from trying to keep up with peers.”

Throughout his life, Kiyosaki has been struck by how neglected financial literacy remains, even among intelligent and successful individuals.

He argues that fundamental concepts in accounting, budgeting, investing, and tax laws are often overlooked, despite their critical importance for achieving desired financial outcomes.

If individuals neglect to dedicate time to learning and mastering these essential skills, it’s no surprise that concepts like Bitcoin seem out of reach to many, as they exceed their comfort zone for exploration.

Post Comment