Solana Rises 8% Amid Global Economic Uncertainty. Is $155 Within Reach Soon?

Political tensions and shifting trade regulations are increasingly influencing cryptocurrency markets, with Solana taking center stage amidst worldwide economic challenges.

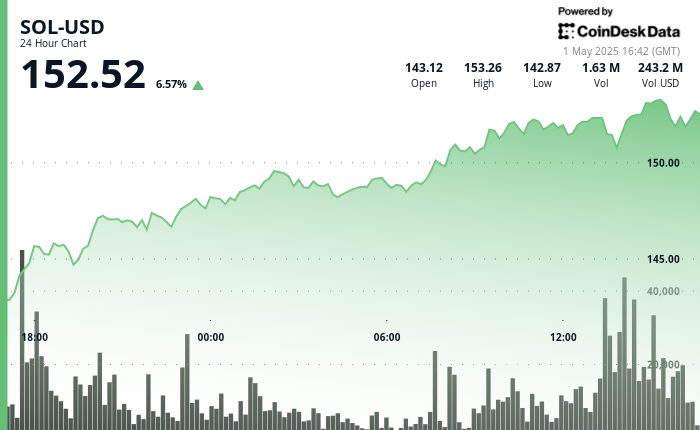

SOL has demonstrated considerable strength in its recovery, rising by 8% from its April 30 low of $140 to approximately $152, alongside a 35% surge in daily trading volume. This rebound coincides with the declining trade relations between the U.S. and China, which are having broad implications for both traditional and digital asset markets.

The CoinDesk 20 Index, which tracks a diverse array of cryptocurrencies, also saw a gain of around 4% on Thursday.

Key Insights from Technical Analysis

- SOL bounced back from a notable correction of 7.4% on April 30, declining from 148.03 to 140.63 before reaching new highs of 152.69.

- The trading activity spanned a range of 12.04 points (8.3%), exhibiting volatility, with robust support identified at 140.65.

- Volume metrics indicate considerable trading activity during the correction phase (over 2.4 million), followed by consistent buying interest as recovery unfolded.

- Current price movements trace out an upward channel, facing resistance near 152.50, while the area between 148.50 and 149.50 is identified as critical support according to recent technical assessment.

- Bullish trends appear stable, as higher lows continue to form, suggesting the possibility of movement towards the psychologically significant level of 155.00.

- Over the last 100 minutes, SOL exhibited heightened volatility, sharply dropping from 152.38 to a low of 150.74, before rebounding swiftly to 152.49.

- Critical support has materialized at 151.10, where noteworthy buying volume (over 44,000) has been observed.

- A mid-session surge from 151.22 to 152.60 coincided with the peak trading volume (126,000 at 14:00), reflecting strong interest from institutional players.

- An ascending channel has formed in the short term, with resistance situated at 152.68 and support at 152.32.

- The region from 152.45 to 152.50 now serves as immediate resistance, potentially influencing short-term market direction.

Post Comment