Regulated exchanges are crucial for igniting the altcoin season.

The following is a guest post and opinion from Przemysław Kral, CEO of zondacrypto.

The introduction of the Markets in Crypto-Assets (MiCA) regulations has significantly transformed the European cryptocurrency landscape for the better. This shift has ushered in a new phase where exchanges must focus on regulatory adherence, prioritizing user safety as they aim for mainstream acceptance. The eagerness within the industry to create a more regulated environment is evident, especially with various exchanges choosing to delist non-compliant stablecoins.

The altcoin market stands to witness considerable expansion as regulations firm up in the coming months. Besides ensuring adherence to rules, regulated exchanges play a crucial role in the sustainable growth of the altcoin sector. The ongoing journey towards compliance and the evolution of the altcoin market within the EU will hinge on these exchanges’ ability to foster innovation and adjust during this pivotal period.

The Effect of Regulation: An Inevitable Contraction?

The removal of non-compliant stablecoins is merely the initial step; MiCA regulations will further influence operational standards, consumer safety measures, and anti-money laundering practices. The intent of MiCA is to enhance trust and security, especially as other financial hubs like Singapore and Hong Kong strive to support innovation through more flexible regulations. The expenses related to compliance, alongside the anticipated decline in trading volumes due to delistings, will inevitably exert deflationary pressures on the sector.

Although these short-term challenges may seem disruptive, they are essential for achieving long-term viability. Exchanges must decide whether to evolve or risk obsolescence. The pivotal question remains: Can the industry successfully navigate this transition while sustaining its growth momentum?

Mitigating (Over)Regulation

Capitalizing on altcoins represents a prime opportunity for growth that can balance out deflationary trends. Altcoins are poised for significant advancement, even as Ethereum experiences stagnation and Bitcoin withdraws from its earlier peak, despite initial policy proposals affecting the market.

The progression of the altcoin market is intertwined with the future of the sector: Altcoins are at the forefront of building robust ecosystems that deliver genuine utility and practical solutions, contrasting with memecoins that thrive mainly on speculation and social media hype. Recent incidents, such as the Libra controversy, clearly illustrate the waning interest in memecoins.

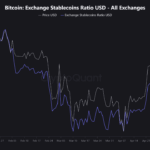

Forecasts indicate that altcoins may surpass Bitcoin’s dominance in the upcoming market cycle, moving beyond the traditional asset rotation dynamics. Even as Bitcoin fluctuates, falling below $80K, altcoins have shown relatively minor declines, avoiding new lows this year, suggesting reduced selling pressure and the potential for a rally driven by rising buying interest. The ongoing influx of institutional investments underscores this growth, as investors seek diverse opportunities beyond just Bitcoin and Ethereum.

This growth potential relies heavily on a secure trading infrastructure. Regulated exchanges have transitioned to being pivotal stewards of a viable future, far exceeding their earlier roles as mere transaction processors.

Innovation Within Frameworks

Stable and legally sound trading conditions are critical for harnessing the growth potential of altcoins. Regulated exchanges provide the necessary infrastructure for projects to thrive within a transparent marketplace, enabling the growth and mainstream acceptance of cryptocurrencies.

Complying with regulations like MiCA has become a fundamental industry standard, laying the groundwork for the sustainable development of altcoins. By emphasizing investor protection and market credibility, regulated exchanges foster a secure environment for both projects and investors. The long-term viability of the crypto market and the influx of institutional capital are contingent on this regulatory clarity. This new phase is not merely about token profits; it represents the structural evolution of an entirely new marketplace.

Embracing a Responsible Altcoin Growth Era

The EU is rapidly establishing itself as a premier global center for cryptocurrency, surpassing North America and Asia in areas like crypto banking. Regulatory frameworks such as MiCA are instrumental in cultivating an environment that prevents past memecoin failures, ensuring that the impact of cryptocurrency remains enduring and positive.

In this context, regulated exchanges lay the groundwork for cryptocurrency innovation to thrive by promoting legal transparency and fostering a compliance-oriented culture. The establishment of altcoin initiatives with real utility and sustainable potential is facilitated by this infrastructure, which guarantees the sector’s growth is grounded in reliable and stable conditions. We stand on the threshold of a new era, with compliant exchanges leading the charge.

Post Comment