Bitcoin Set to Reach $450,000 in a Liquidity-Driven Supercycle

Why You Can Rely on Us

Robust editorial standards committed to precision, significance, and objectivity.

Developed by seasoned professionals and thoroughly vetted.

Adherence to the highest benchmarks in journalism and publication.

Robust editorial standards committed to precision, significance, and objectivity.

Vestibulum id ligula porta felis euismod semper. Nulla vitae elit libero, a pharetra augue.

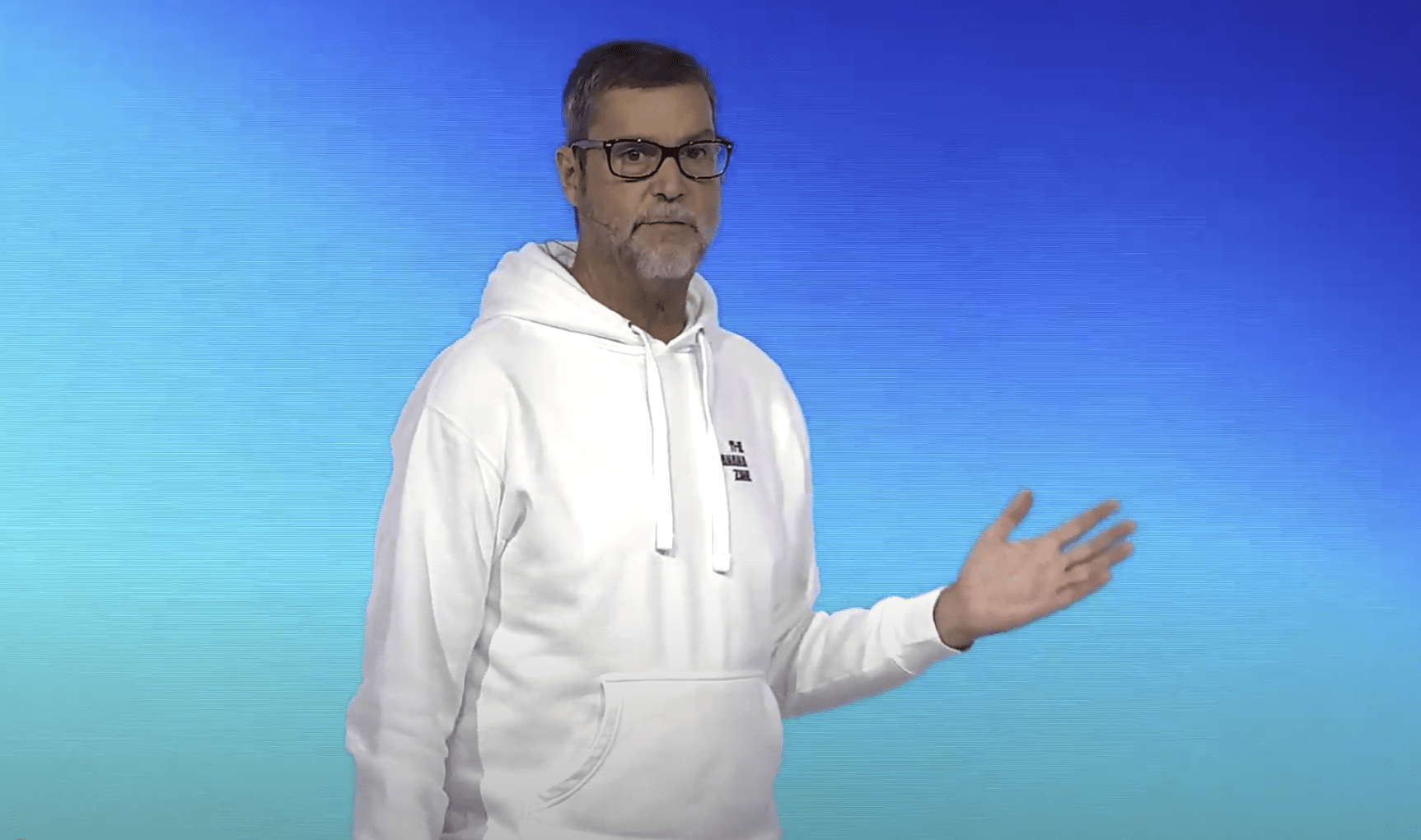

At Sui Basecamp, macro investor and co-founder of Real Vision, Raoul Pal, presented an all-encompassing address portraying the current crypto landscape as the start of a “liquidity-driven supercycle,” with Bitcoin potentially reaching $450,000 before it concludes. Drawing from extensive macroeconomic research spanning over three decades, Pal described his view through what he calls the “Everything Code,” a framework focusing on global liquidity, debt cycles, and currency erosion as the fundamental forces influencing asset values across all markets.

Why $450,000 Bitcoin is Feasible?

Pal stated, “Bitcoin’s year-over-year rate of change is influenced by financial conditions with a three-month delay,” highlighting the consistent correlation between global liquidity and the price movements of key assets. “The link between Bitcoin and global liquidity stands at 90%, and 95% with the Nasdaq. It’s hard to argue against that.” He emphasized that this connection is fundamentally linked to the operations of the contemporary macroeconomic system, especially in the aftermath of the 2008 crisis, characterized by persistent debt burdens and systematic liquidity infusions.

Many individuals, according to Pal, misinterpret the actual catalysts of crypto cycles. “While discussions often center around the halving, this is chiefly about the cycle of debt refinancing. Every four years, global debt resets, prompting central banks to inject liquidity to prevent systemic breakdown.” He noted that the average duration of global debt is approximately four years, primarily located within the three- to five-year range, producing natural cyclical waves of liquidity that align with crypto market expansions.

Pal characterized the situation as a global financial shell game: “Limited assets continue to increase in value—real estate, stocks, art, gold. Younger generations find them unaffordable. What’s essentially occurring is a global taxation effect of around 8% each year that goes unnoticed. Combine that with an additional 3% global inflation, and the total devaluation stands at 11%.” In this context, Bitcoin emerges, in Pal’s perspective, as a logical refuge for capital due to its fixed supply and decentralized character.

When Will BTC Peak?

Pal describes the current phase as entering “the banana zone,” referring to the rapid escalation stage of the crypto cycle where prices rise steeply. “Each cycle presents a similar pattern. Breakout, retest, banana zone. We have already experienced banana one, followed by the corrective zone, and now banana two. What follows next is banana three.” He believes that the existing conditions are exceptionally robust due to a convergence of factors: synchronized global liquidity growth, a declining dollar, central banks beginning to relax monetary policy, and both retail and institutional entities being underexposed to risk assets.

As Pal concluded his address, he reiterated his thesis with a sense of urgency and caution: “We have central banks devaluing currency, providing us with a substantial tailwind. They do not desire the system to falter. Each time an event occurs, they infuse additional liquidity. They are essentially gifting you money. To take advantage of that, volatility is essential.” He advised against excessive trading, using leverage, or panicking during unavoidable market pullbacks. “Do not mismanage this,” he cautioned, referencing his past errors during the 2017 bull run. “Hold onto your assets. Exercise caution. Avoid FOMO. Monitor the liquidity closely.”

Pal envisions this cycle potentially extending into the first or second quarter of 2026, especially if political elements concerning a possible Trump re-election propel the liquidity cycle further. Whether Bitcoin will ultimately achieve $450,000 is yet to be determined, but Pal’s viewpoint is unmistakably clear: the macroeconomic forces are favorable, the evidence supports it, and this may represent— as he articulates— “the most remarkable macro opportunity in history.”

At the time of writing, BTC was trading at $94,191.

Post Comment