Solana (SOL) Encounters Ongoing Bearish Pressure—Further Declines Anticipated

Solana has begun a new downward trend starting from the $155 mark. Currently, the SOL price is stabilizing around $145 and may experience further declines beneath the $142 support level.

- The price of SOL has initiated a decline, falling below $150 and $148 against the US Dollar.

- It is now trading under the $150 mark and below the 100-hour simple moving average.

- A short-term rising channel or continuation pattern is emerging, with support at $144 on the hourly chart for the SOL/USD pair.

- The pair could see an upward movement if it surpasses the $148 resistance level.

Solana Price Stabilizes

The price of Solana has established support above the $142 level and is beginning to rise again, similar to Bitcoin and Ethereum. SOL is gaining momentum and has moved past the $145 and $150 resistance points.

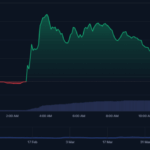

Nonetheless, sellers remained active beneath the $155 resistance area. The peak reached was $153.90, followed by a subsequent decline. The price fell below both $150 and $148, eventually hitting a low of $142.64, and is currently consolidating its losses.

A slight increase occurred above the 23.6% Fibonacci retracement level of the drop from the $153.90 high to the $142.64 low. Solana is presently trading below $150 and under the 100-hour simple moving average. There is a short-term upward channel developing, with support located at $144 on the hourly chart of the SOL/USD pair.

On the upside, resistance is encountered around the $147 mark. The next significant resistance lies near $150 and the 61.8% Fibonacci retracement of the drop from the $153.90 high to the $142.64 low. The primary resistance level is positioned at $155. A successful closure above this zone could lead to a further steady increase, with the next key resistance target as $165. Continued gains could push the price toward the $180 range.

Further Declines in SOL?

If SOL cannot break above the $150 resistance, it may initiate another decline. The initial support on the downside is near the $145 region, with the first key support located around $142.

A dip below the $142 level could lead the price toward the $135 zone. If a closure occurs beneath the $135 support, it may result in a further decline to the $122 level in the short term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is intensifying in the bearish territory.

Hourly RSI (Relative Strength Index) – The RSI for SOL/USD remains below the 50 mark.

Major Support Levels – $145 and $142.

Major Resistance Levels – $147 and $150.

Post Comment