Deribit BTC Options Market Shows Increased Institutional Trust in Bitcoin

Bitcoin (BTC) is experiencing a significant upsurge, with institutional investors increasing their engagement through the Deribit BTC options platform.

Recent data from the past week indicates heightened institutional activity around BTC, reflecting positive inflows into options, as announced by Deribit on their social media platform.

The exchange has noted considerable purchases of call options, particularly at the $110,000 strike price for June and July expiration dates, along with calendar spreads that involve a long position on the $140,000 call option set to expire at the end of September and a short position on the $170,000 call for the year’s conclusion.

This substantial interest in the $110,000 call option suggests robust expectations for a continued upward trajectory in BTC prices in the near future, possibly reaching $140,000 or higher.

Call options grant holders the choice, rather than the obligation, to purchase the asset at a specified price within a designated timeframe. Such activity generally signals bullish sentiment in the market.

Additionally, Deribit reported that these bullish trends also included the transition of long positions from the May expiration to the July expiration within the $110,000 to $115,000 strike range.

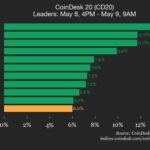

Data from CoinDesk indicates that BTC reached a peak of $104,000 on Thursday, showing a nearly 40% recovery since hitting lows below $75,000 in early April, driven by optimism stemming from a recent trade agreement between the U.S. and U.K. and steady inflows into spot ETFs. Technical analyses suggest further upward movement is likely.

Ether, the native cryptocurrency of the Ethereum network, has surged more than 30% to $2,411 within just two days, indicating a bullish breakout according to technical indicators. This development has sparked interest in bullish ETH strategies on Deribit, with traders actively purchasing June-expiration calls at $2,400, as well as long call spreads projecting gains up to $2,600 to $2,800.

Post Comment