Trump’s $6 Billion UK Trade Agreement Helps Bitcoin Surpass $100,000

Reasons to Trust

Rigorous editorial standards emphasizing precision, relevance, and neutrality

Developed by specialists in the field and carefully evaluated

Commitment to top-tier reporting and publishing practices

Rigorous editorial standards emphasizing precision, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC), the leading cryptocurrency in the market, has surpassed the $100,000 milestone for the first time since February, fueled by a significant change in President Donald Trump’s tariff measures, rekindling optimism within the crypto sphere.

Bitcoin Stands Just 6% Short of Its Peak

In recent months, Trump’s tough tariff approach adversely influenced cryptocurrency valuations, resulting in a notable downturn for Bitcoin, which plummeted to approximately $74,000, indicating a 25% drop from its peak of $109,000 recorded in January.

Nevertheless, the President’s recent choice to halt his “tariff war” has catalyzed a significant recovery in crypto valuations, enhanced by a $6 billion trade agreement with the UK declared on Thursday.

Additional Insights

In the last thirty days, the market’s leading cryptocurrency has experienced a remarkable 31% price increase, placing it just 6.7% beneath its historic high. Antoni Trenchev, one of the founders of the crypto exchange Nexo, noted that:

Bitcoin not only returned above $100,000 for the first time in three months but has also reinforced its reputation as the most recoverable asset as optimism around US trade agreements improves.

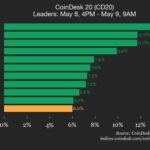

Other significant cryptocurrencies have gained from this transition as well. Ethereum (ETH) has reclaimed the $2,000 level for the first time since late March, witnessing a 12% rise within just 24 hours, while Dogecoin (DOGE) closely followed with an 11% increase.

Trenchev highlighted that Bitcoin’s recent success is supported by a pro-crypto government and heightened interest from investors in spot-exchange-traded funds (ETFs). He asserted that Bitcoin’s superior performance against US stock indices in 2025 solidifies its position as a robust and safe-haven investment.

Analysts Caution About Future Challenges Amid Global Instability

In spite of the prevalent positive sentiment, Trenchev warned that Bitcoin’s durability will face scrutiny in light of an unpredictable global economic climate and geopolitical tensions.

Elevated tensions between India and Pakistan pose possible threats, as well as the cautious stance of the US Federal Reserve regarding potential interest rate cuts due to worries over unemployment and inflation.

Additional Insights

Since the initiation of the tariff policy in early April, Bitcoin has seen an increase of over 16%, while spot gold has risen nearly 6%, and the S&P 500 has only shown slight improvements, highlighting Bitcoin’s increasing allure as a safeguard against variations in traditional markets.

To solidify its upward trajectory, experts believe Bitcoin must surpass its January high exceeding $109,350. Trenchev suggested that the cryptocurrency’s price may oscillate between $70,000 and $109,000 in the months leading up to the election.

Regardless, he underscored the importance of reclaiming the $100,000 threshold as a notable victory for Bitcoin. “Purchasing during market fear—just last month Bitcoin hovered around $74,000—can yield significant returns,” he concluded.

Featured image derived from DALL-E, chart from TradingView.com

Post Comment