XRP Price Signals 2017 Death Cross, Potentially Leading to 325% Surge to $9

Why You Can Rely on Us

We maintain a rigorous editorial policy that emphasizes precision, relevance, and neutrality.

Content crafted by seasoned professionals and thoroughly vetted.

Adherence to exemplary standards in journalism and publication.

We maintain a rigorous editorial policy that emphasizes precision, relevance, and neutrality.

Our content strategy combines insightful analysis with compelling storytelling to engage readers.

XRP is making waves once more after demonstrating remarkable strength in recent days, recovering from lows of $2.08 earlier this week to settle at $2.4 recently. This upward trend, now reflecting gains exceeding 15% from the $2 support level, has revealed an intriguing historical pattern on XRP’s daily chart.

When comparing XRP’s current price formation with its 2017 performance, it appears that a rare configuration could signify an impending significant breakout, potentially targeting prices as high as $9.

The XRP Price Shows a 1D Death Cross Signal, But History Suggests Otherwise

At first glance, a death cross has formed on the daily candlestick chart for XRP. This technical pattern occurs when the 50-day moving average falls below the 200-day moving average, typically seen as a bearish signal. However, a crypto analyst on TradingView presents an alternative view on this situation for XRP.

Scrutinizing historical trends from 2017 implies that this signal might not spell doom for XRP. During that period, XRP showed almost identical trading patterns within a descending triangle just prior to the death cross formation. This marked a misleading shift, as XRP’s price swiftly reversed direction and surged upwards. Following the 2017 death cross, XRP reached the 1.5 Fibonacci extension zone, yielding gains exceeding 1,350% from its pre-breakout price of $0.23, up to its peak of $3.4.

Currently, XRP has spent several months consolidating within a tight descending triangle leading up to this year’s first death cross in over a year. Despite the typical bearish interpretations associated with this cross, the resemblance in chart patterns to those of 2017 renders this situation a bullish anomaly.

If XRP’s price mirrors the bullish trajectory seen after the 2017 death cross, it could potentially break through to new all-time highs at the 1.5 Fibonacci extension. The analyst has pointed out that this target for the current year stands near the $9.00 mark, indicating a robust 325% increase from XRP’s present price.

XRP 2017 Price Chart: Image From TradingView

XRP 2025 Price Chart: Image From TradingView

Indicators Remain Neutral Yet Positive

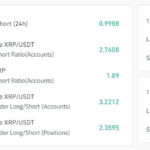

Interestingly, the XRP price shows a neutral yet hopeful technical outlook on longer timeframes. The Relative Strength Index (RSI) for XRP stands at 54.799 on the weekly chart, indicating it still has significant upward potential before hitting overbought territory. The MACD reading of 0.197 suggests mild upward momentum, while the ADX sits at 30.423.

Related Insights

As of the latest updates, XRP is trading at $2.38. The optimistic scenario proposed by the analyst largely hinges on institutional interest aligning with the anticipated technical breakout.

Featured image from Unsplash, chart from TradingView

Post Comment