Ethereum Surges Unexpectedly Above $2,500, Surpassing Bitcoin

Ethereum has made headlines again, surging 42% in the last week to surpass $2,500, a price point it has not reached since March.

This significant rally represents one of the most substantial breakouts in over a year, indicating a revival of confidence among investors.

On-chain metrics indicate that this price increase has resulted in over 60% of Ethereum wallets being in profit, nearly doubling the 32% noted just a month ago, which underscores the market’s robust recovery.

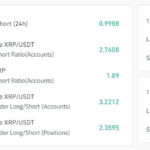

Additionally, Ethereum’s performance has outpaced that of Bitcoin recently. While Bitcoin experienced a 10% increase during the same timeframe, rising above $105,000, Ethereum’s more drastic gains have caught many off guard.

This surge has sparked speculation that Ethereum might be entering a bullish trend after a prolonged period of lackluster performance. A research lead at Dervive.xyz commented:

“The probability of ETH exceeding $4,000 by Christmas has increased to 20% (up from 9% last week), and the likelihood of reaching $5,000 stands at 12%. The chance of ETH dropping below $1,500 by Christmas has decreased to 15% (down from 40%).”

What is fueling Ethereum’s superior performance?

Market experts attribute Ethereum’s recent activities to several vital elements: technical advancements, growing institutional interest, and improving global conditions seem to be driving its upward trend.

Recently, Ethereum finalized its eagerly awaited Pectra upgrade, which introduced a variety of enhancements to the blockchain network.

This update improved wallet features, streamlined validator functions, and boosted Layer 2 compatibility. These changes are anticipated to enhance Ethereum’s efficiency and user-friendliness within decentralized finance applications.

Moreover, increased engagement from a number of traditional financial institutions, including BlackRock, is propelling Ethereum’s rise as they integrate its infrastructure through the tokenization of real-world assets.

Data indicates that this segment has surged over 10% in the last month, reaching a cumulative value of $22.1 billion. Ethereum holds the lead in the market with $6.9 billion locked in tokenized assets, claiming 58% of the market share.

In addition, positive macroeconomic developments are lifting spirits in the overall market.

A recent trade agreement between the US and UK, along with a temporary halt in escalating tariffs between the US and China, has alleviated investor anxieties.

These geopolitical factors foster a heightened risk appetite across global markets, providing Ethereum additional upward momentum.

Post Comment