How the US-China 90-Day Tariff Reduction Could Elevate Bitcoin Prices Beyond $110,000

Reasons to Trust

Rigorous editorial standards prioritizing accuracy, relevance, and neutrality

Produced by professionals in the field and thoroughly vetted

Commitment to maintaining the highest quality in both reporting and publication

Rigorous editorial standards prioritizing accuracy, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The value of Bitcoin, along with the broader crypto and stock markets, has been significantly impacted by the trade tensions initiated by the US administration following the election of President Trump. The first wave of tariff escalations directed at countries like China resulted in steep declines across financial markets, dropping Bitcoin’s price below $80,000. Nevertheless, recent developments suggest that these tariff struggles may be coming to a close with the latest updates from government officials on US-China trade relations.

Notification of China Tariff Reductions

In April 2025, President Trump announced a steep hike in tariffs on Chinese imports, soaring to 145%, with similar increases affecting over 180 other nations. This sparked widespread panic, leading to retaliatory measures and defining what is now referred to as the ‘tariff wars.’ As negotiations continued, another notice in April revealed a 90-day suspension of tariffs for other nations, excluding China.

Related Reading

Although China was not included in this exemption, the temporary halt positively influenced financial markets, allowing Bitcoin’s price to rebound and benefiting the overall crypto landscape. Since this announcement, Bitcoin has surpassed $100,000, and stock markets have experienced several days of gains.

Continued conversations between the US and China are in progress, leading to a provisional agreement. According to an official statement from the White House, both governments at the US-China Economic and Trade Meeting held in Geneva have consented to alter their tariff applications and implement a suspension of tariffs by 24 percentage points.

This agreement is slated to last for an initial period of 90 days, providing ample time for both nations to continue discussions towards a long-term resolution. The announcement emphasized a commitment to “reciprocal opening, ongoing communication, collaboration, and respect between the parties.”

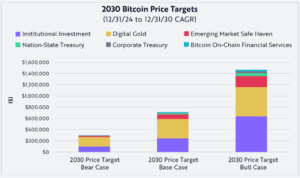

Potential Surge in Bitcoin’s Value

Currently, the surge in Bitcoin’s price is fueled by optimistic news relating to the tariffs. Consequently, it is anticipated that further positive developments will continue to bolster its value. The agreement stipulates that both the US and China should finalize their tariff reductions by May 14, 2025. As the deadline approaches, it may trigger an additional price rally.

Related Reading

As news of the tariff suspension circulates, it signals an absence of negative updates regarding tariffs for at least the forthcoming three months. This creates a sense of assurance and confidence among investors in high-risk assets like Bitcoin. With an influx of investors returning to the risk market, Bitcoin’s valuation could potentially breach $110,000 as soon as Wednesday.

Featured image from Dall.E, chart from TradingView.com

Post Comment