Chinese-affiliated company secures $300 million from private investor to acquire TRUMP memecoin.

An obscure technology firm with connections to China is set to invest up to $300 million in Bitcoin and a memecoin associated with Trump, as detailed in a filing with the US Securities and Exchange Commission dated May 11.

This announcement has triggered concerns regarding potential conflicts of interest and regulatory oversights, particularly as it might financially benefit the Trump family. Concurrently, discussions are ongoing about the possibility of banning TikTok in the United States.

This comes on the heels of criticism directed at the president for hosting a lavish dinner for major TRUMP token holders, where prominent investors were even offered a personal meeting with him.

The firm making this announcement, GD Culture Group, is listed on Nasdaq, employs only eight people, and reported no revenue in the previous fiscal year. Although it claims to manage a TikTok-based e-commerce platform, its strategies appear to be evolving.

In its recent filing, GDC disclosed plans to direct funds towards Bitcoin and the TRUMP token, financed by a private stock placement to an undisclosed entity registered in the British Virgin Islands, known for its tax benefits and privacy.

Transforming a low-value stock into a crypto powerhouse

Until now, GD Culture Group has maintained a low profile. Its operations in China and dependence on a platform like TikTok limited its visibility in Western investment circles. However, this changed significantly when it announced plans to secure hundreds of millions via a two-year equity line with a single accredited investor.

The company can issue a Purchase Notice to the investor at its discretion, prompting the buy of newly issued GDC shares. The initiative could generate up to $300 million in funding through these share sales.

The investor’s stake is capped at 4.99% of outstanding shares, with a potential increase to 9.99% upon providing a notice period. For now, GDC is limited to issuing no more than 3,357,407 shares, which equates to 19.99% of its current float, known as the “Exchange Cap.”

At a minimum price of $0.44 per share, raising the full $300 million would necessitate issuing approximately 682 million new shares, substantially exceeding the existing 16.8 million shares and surpassing the 19.99% Exchange Cap.

Consequently, unless GDC’s stock sees a significant price increase or shareholders lift the cap, the firm cannot immediately access the total $300 million.

If executed as filed, GDC’s assets could skyrocket from $14 million at the end of 2024 to potentially over $300 million, positioning the company among the largest holders of the TRUMP token, a memecoin introduced recently that has directed over $320 million in fees to affiliates of Donald Trump and his family.

Interplay of politics, cryptocurrency, and TikTok

The timing of this financial maneuver is particularly controversial. Lawmakers are currently deliberating a potential TikTok ban, motivated by national security risks tied to its Chinese ownership. President Trump has shown support for a compromise that would allow the app to remain operational in the US, conflicting with the views of numerous legislators.

GD Culture Group’s announcement intersects with this political debate. Ethics specialists contend that any financial benefits accruing to the Trump family from this decision would likely constitute a significant conflict of interest.

The company’s new focus on cryptocurrency closely resembles the approach taken by Strategy, a software firm that transitioned into a major Bitcoin holder. However, while Strategy boasts a profitable history, GDC lacks revenue and transparency.

In February, the SEC clarified its stance on memecoins, asserting those types of transactions do not classify as unregistered securities under federal law.

Unresolved issues, market effects

Despite the provocative nature of the announcement, the specific details regarding the investment remain unclear. The firm has not outlined a timeline for the acquisitions, any protective measures, or the identity of the private investor, suggesting that the initiative might be more symbolic than practical.

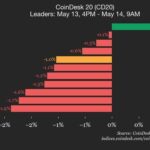

Nonetheless, the TRUMP token has seen an uptick in activity, with more than 287 holders and robust trading volume. A $300 million inflow could significantly influence the token’s liquidity and market valuation, especially if the buyer engages actively in the market.

However, it’s unlikely that the entire budget will be dedicated exclusively to the TRUMP token; the portion allocated to Bitcoin may have a muted impact, considering the size and stability of that market.

The success of this investment strategy for GD Culture Group and the Trump family will likely depend on legislative decisions regarding the morality of president-associated memecoins.

As digital assets capture attention, this unlikely collaboration between a China-linked TikTok entity and a Trump-themed memecoin could emerge as one of the most peculiar financial narratives of 2025.

Post Comment