Retail Demand for Bitcoin Increases by 3.4% as Small Investors Re-enter the Market

Reasons for Confidence

A rigorous editorial framework prioritizing accuracy, relevance, and neutrality

Developed by experts in the field and carefully evaluated

Adherence to the highest reporting and publishing standards

A rigorous editorial framework prioritizing accuracy, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Participation from retail investors in the Bitcoin (BTC) market is increasing, as on-chain metrics show that smaller investors are slowly re-engaging. This uptick often indicates a rising confidence in Bitcoin and may serve as a trigger for price increases.

Retail Engagement in Bitcoin Is Rising

Recent insights from an analyst indicate that retail investors—identified as wallets with under $10,000 in BTC—are gradually making a comeback. These investors are usually quite responsive to market changes.

Related Insights

The analyst remarked that while retail investors might not always make timely decisions like institutional ones, their activity serves as an important gauge of overall market sentiment. The influx of retail investors can create a feedback loop that bolsters positive sentiment and increases buying pressure, attracting even more market participants.

The BTC: Retail Investor 30-Day Change indicator illustrates this trend well. Since it turned positive on April 28, there has been a 3.4% increase in retail purchases leading up to May 13, indicating a notable resurgence in activity among small investors.

The analyst stated that if Bitcoin continues to rise, other areas of the crypto market could also see gains, as retail investors might begin exploring other assets in search of greater returns. He stated:

This could positively impact the entire cryptocurrency landscape, as smaller investors are inclined to branch out into various projects, including DeFi, staking, and other investment options. All indicators suggest this change in retail investor behavior may signify the onset of a new phase of widespread adoption in cryptocurrency.

He also highlighted the importance of tracking other on-chain metrics like active addresses, unspent transaction outputs (UTXOs), new address creation, and transfer volumes, which typically correlate with rising retail participation.

Cautionary Signals for BTC

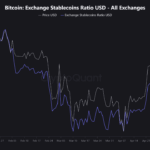

Though increasing retail interest is a positive development, there are some warning signs that merit caution. For instance, the Exchange Stablecoins Ratio (USD) recently climbed to 5.3 amid Bitcoin’s surge to $104,000. This suggests that Bitcoin reserves on exchanges may now surpass stablecoin reserves, indicating potential selling pressure.

Related Insights

A contributor pointed out that historical data shows readings above 5.0 are significant. A previous spike to 6.1 in January preceded a sharp price correction, suggesting that investors might be moving from Bitcoin back to cash.

Despite some indicators of caution, Bitcoin continues to show positive momentum. The Stochastic RSI indicates renewed vigor, and additional technical indicators point to the possibility that the rally may persist. Currently, BTC is trading at $103,993, which is a 0.3% increase over the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

Post Comment