Fidelity’s Macro Director Advocates for 4:1 Allocation in Gold and Bitcoin as Safe-Haven Assets

Jurrien Timmer, the Director of Global Macro at Fidelity, pointed out that Bitcoin surpassing the $100,000 mark this week aligns with a significant convergence of its 52-week Sharpe ratio compared to gold.

Timmer remarked,

Following gold’s impressive performance, it seems Bitcoin may be taking the lead again, with its price above $100,000 and both assets’ Sharpe ratios now aligning… Gold’s volatility has been approximately 4:1 in relation to Bitcoin, indicating similar relative performance between the two.

— Jurrien Timmer, social media post, 16 May 2025

Key figures

- Bitcoin price: ≈ $103,600 (16 May 2025)

- Gold price: ≈ $3,213 / oz (16 May 2025)

- 52-week Sharpe ratio: Gold 1.33 | Bitcoin -0.40

- Timmer’s allocation guideline: 4 parts gold, 1 part Bitcoin

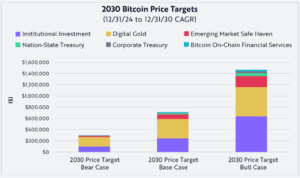

Gold has achieved 67 record closes since the beginning of 2024 and is currently up about 33 % year-to-date. In contrast, Bitcoin has shown an increase of approximately 25 % from its low of nearly $76,000 in April. This convergence in Sharpe ratios indicates that Bitcoin’s risk-adjusted returns are getting closer to those of gold.

Importance of the 4:1 ratio

Timmer’s approach, which scales gold holdings to be four times that of Bitcoin, reveals a close correlation between historical volatility and cumulative returns for both assets.

This guideline positions the two assets as complementary stores of value, rather than rivals, providing investors with a strategy to balance inflation protection along with exposure to the digital asset market.

- Portfolio strategy: A diversified approach may help mitigate Bitcoin’s downturns without compromising long-term potential for real returns.

- Market watch: A weakening trend in gold combined with an improving Bitcoin Sharpe ratio might trigger a strategic shift towards cryptocurrency.

- Risks: Bitcoin’s negative Sharpe ratio indicates vulnerability; regulatory changes or liquidity challenges could cause a widening disparity again.

Post Comment