Ethereum Experiences $205M in Weekly Inflows After Successful Pectra Upgrade

Digital asset investment products have seen a consistent influx for the fifth week in a row, totaling $785 million. This surge brings the yearly inflows to an impressive $7.5 billion, surpassing the earlier record of $7.2 billion set in February. The recent investment activity has effectively offset the $7 billion in outflows experienced during the downturn in February and March.

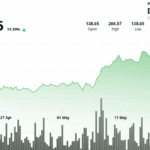

Among the digital currencies, Ethereum demonstrated particularly strong gains.

As highlighted in the latest report from CoinShares, Ethereum’s inflows amounted to $205 million in the past week, raising its total for the year to $575 million. This increase signals a resurgence of investor confidence, especially following the successful launch of the Pectra upgrade on May 7th, which was delayed multiple times, along with the appointment of co-executive director Tomasz Stańczak.

Bitcoin also experienced significant inflows of $557 million, although this figure is lower than the previous week, likely due to the Federal Reserve’s ongoing hawkish approach. Additionally, short-bitcoin products brought in $5.8 million for the fourth week in a row, indicating that investors are looking to hedge against rising prices.

In the same timeframe, Sui and XRP reported inflows of $9.3 million and $4.9 million, respectively, while Cardano and Chainlink attracted smaller amounts of $0.5 million and $0.2 million. Conversely, Solana faced outflows of $0.89 million, and multi-asset products experienced even greater withdrawals totaling $2.9 million.

Investor sentiment varied significantly by region. The US led with substantial weekly inflows of $681 million, while Germany and Hong Kong added $86.3 million and $24.2 million, respectively, marking the largest inflow for Hong Kong since November 2024. Australia and Switzerland contributed smaller amounts of $13.5 million and $2.7 million, respectively.

In contrast, Sweden, Canada, and Brazil all experienced negative sentiment, with outflows amounting to $16.3 million, $13.5 million, and $3.9 million over the week.

Post Comment