Bitcoin Soars to All-Time High, Surpassing Amazon and Google to Rank 5th Among Global Assets

Reasons to Trust

A rigorous editorial framework prioritizing factual accuracy, relevance, and neutrality

Developed by specialists in the field and thoroughly vetted for accuracy

Adhering to the highest reporting and publishing standards

A rigorous editorial framework prioritizing factual accuracy, relevance, and neutrality

Curabitur pretium lectus et nisl consequat, vulputate quis tellus. Vestibulum eu odio euismod

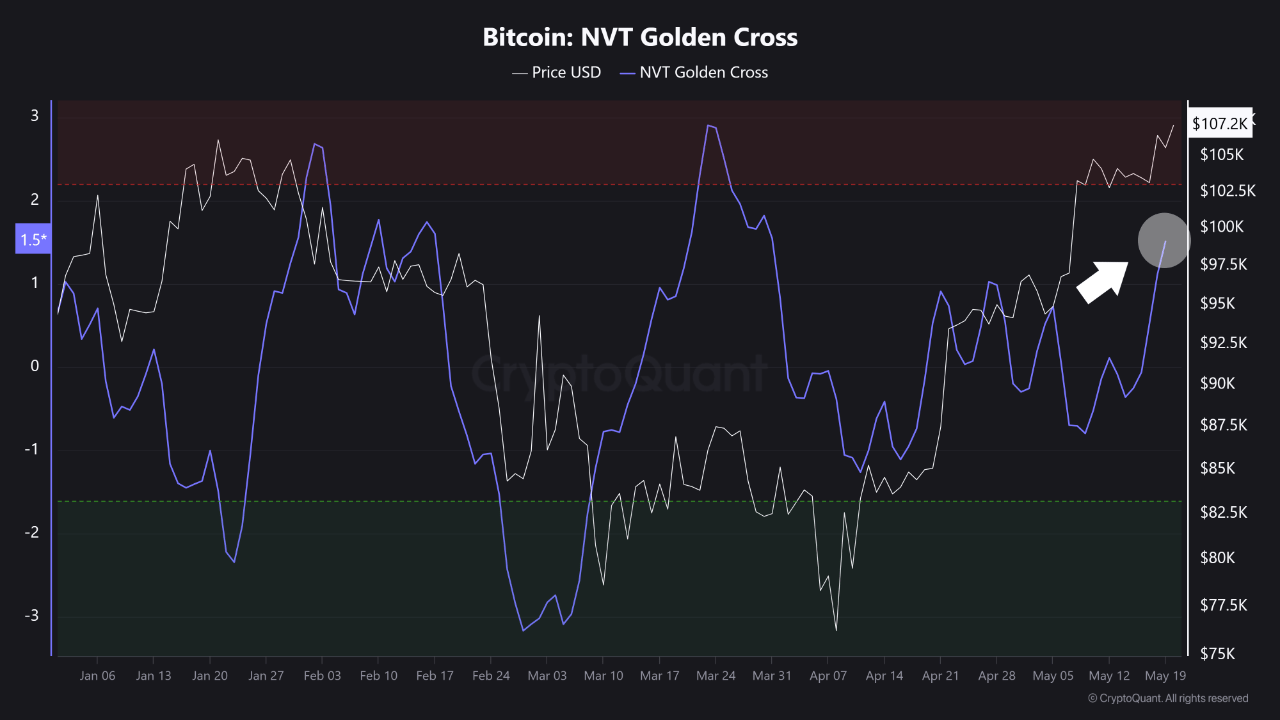

On May 21, Bitcoin (BTC) made a significant leap, achieving an unprecedented all-time high (ATH) close to $110,000. This increase was driven by substantial buying activity, which raised Bitcoin’s market value to over $2.1 trillion.

As a result, Bitcoin has solidified its position as one of the most valuable assets in the world, now ranking fifth in market capitalization, outpacing major corporations such as Amazon and Google.

Could Bitcoin Outperform Gold?

As noted, Bitcoin’s price surge led to a market capitalization nearing $2.182 trillion. It currently holds the position just behind tech leaders Apple, NVIDIA, and Microsoft, in addition to gold, which boasts a market cap exceeding $22 trillion.

In a recent discussion, Rob Nelson conveyed insights from Gracy Chen, Managing Director at Bitget, who spoke about the transformative potential of the cryptocurrency sector.

Further Reading

Amid growing institutional acceptance, changing regulations, and emerging real-world uses, Chen expressed confidence in Bitcoin’s trajectory. “I firmly believe Bitcoin could surpass gold in market value, potentially within this year or the next few years,” she remarked, indicating that there could be room for Bitcoin to double or triple in price.

Once viewed primarily as “digital gold,” Bitcoin’s role has shifted considerably. While initially considered a hedge against risk, it has grown increasingly intertwined with conventional financial markets, particularly with the anticipated introduction of spot Bitcoin ETFs in 2024.

“In its early days, Bitcoin was largely regarded as digital gold. At present, I still see it as digital gold, but it’s become a riskier asset,” Chen elaborated, pointing out its rising correlation with the US stock market.

Analysts Project Possible Surge to $150,000

Optimistic regulatory changes in the US have enhanced investor confidence, raising expectations for BTC price discovery phases. Antoni Trenchev, co-founder of Nexo, remarked on the present market conditions:

Now that we have surpassed January’s peak—and achieved a 50 percent rebound from April’s lows—Bitcoin is entering blue sky territory, bolstered by institutional momentum and a supportive US regulatory climate.

Further Reading

Trenchev also pointed out that the market is currently in the fourth year of Bitcoin’s price cycle, typically recognized as a significant period after a halving event, which halves miners’ rewards.

Historically, this has been a precursor to major price rises. “Though macroeconomic uncertainties and the possibility of volatility linger, a target of $150,000 by 2025 remains very much achievable,” he concluded.

As of the latest updates, BTC is valued at $109,570, reflecting gains of 3% and 25% over the last 24 hours and 30 days, respectively.

Image from DALL-E, chart sourced from TradingView.

Post Comment