Bitcoin Retreats to Daily EMA 8 – Will Bulls Maintain Their Momentum?

Trust Factors

Robust editorial standards emphasizing precision, significance, and neutrality

Developed by professionals and thoroughly vetted

Commitment to the highest reporting and publishing standards

Robust editorial standards emphasizing precision, significance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

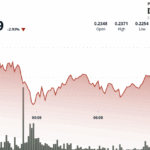

Bitcoin reached a new milestone this week, surpassing $112,000 on Thursday after overcoming resistance just a day prior. This breakthrough represents a pivotal moment in the market, affirming bullish sentiment and entering a fresh phase of price exploration. Nevertheless, the enthusiasm was momentary. After remarks from US President Donald Trump regarding potential 50% tariffs on European Union goods, global markets turned hesitant, creating a widespread risk-averse atmosphere that led to a decline in Bitcoin prices.

The market reacted rapidly, pulling BTC below its recent peaks as investor apprehension rose amid increasing geopolitical and economic fears. While such a retreat is common following a significant surge, it highlights the cryptocurrency market’s vulnerability to macroeconomic developments.

Expert analyst Big Cheds offered a technical viewpoint, indicating that Bitcoin has returned to the daily EMA 8. If this average is maintained, it could suggest that bullish forces remain dominant, and this downturn is merely part of a natural consolidation process.

Bitcoin Remains Strong Amid Market Volatility

Amid ongoing macroeconomic uncertainties, Bitcoin exhibits notable resilience. Even with rising US Treasury yields and volatility shaking global stock markets, BTC has managed to maintain its strength after recently achieving new peak values. Unlike many other risk assets faltering in this environment, Bitcoin is reinforcing its role as a macro hedge, drawing attention from both institutional and retail investors.

However, despite the recent spike to $112,000, a consensus among analysts suggests that a definitive break above $115,000 is crucial to establish a sustainable bullish trend. Without this confirmation, the current upward movement may appear overextended, particularly in the context of overall market instability.

This week, Cheds provided a key technical observation that Bitcoin is now positioned at the daily EMA 8—a moving average that has served as reliable support since it was at the $80K level. This suggests that the current pullback could represent a healthy test of trend support rather than the onset of a more significant decline.

If BTC successfully rebounds from this level, it could quickly regain its upward momentum. Conversely, if the EMA 8 does not hold, the risk of a downturn may increase, particularly if traditional markets continue their downward trend. The focus remains on Bitcoin’s response at this critical technical juncture.

BTC Examines Key Levels as Uptrend Slows

Currently, Bitcoin is assessing essential technical thresholds after its rapid ascent to around $112,000. Observations from the 4-hour chart show BTC has retracted to the 34-period EMA (approximately $107,800), a level that has previously provided dependable dynamic support throughout this upward trend. Recent trading activity indicates buyers are entering slightly above this zone, implying that support is still intact.

The price is also positioned just above the 50-SMA at $106,273, further reinforcing this area as a critical support convergence. A slight uptick in volume during the downturn may reflect healthy profit-taking rather than panic-induced selling, allowing for the potential continuation toward past highs and possibly surpassing $112K.

However, should the support falter and BTC falls under $106K, attention will shift to the next significant horizontal support level at $103,600. A descent to this area would still align technically within the broader upward trend, though it could disrupt short-term bullish sentiment.

Post Comment