Ethereum Celebrates Six Consecutive Weeks of Gains, Attracting $1.19 Billion in Inflows

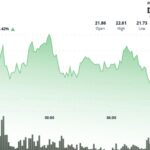

Over the last week, Ethereum has been at the forefront of digital asset investments, showcasing its most successful period since the beginning of 2024.

With an impressive $321 million flowing in over the past seven days, Ethereum’s surge has now reached six consecutive weeks of growth. Cumulatively, this adds up to $1.19 billion during this period, marking the highest inflow since December 2024 and signifying a notable shift in market sentiment.

Asset Management Declines Despite Ethereum’s Success

The most recent report on digital asset fund flows indicates that investment products in this sector experienced $286 million in inflows last week, bringing their seven-week total to $10.9 billion. Nevertheless, total assets under management decreased from $187 billion to $177 billion, attributed to market fluctuations caused by concerns over U.S. tariffs.

Bitcoin began the week strong, but mid-week developments led to a change in momentum following a ruling by a New York Court declaring certain U.S. tariffs illegal. By the end of the week, Bitcoin registered $8 million in outflows, marking its first decline after six consecutive weeks with inflows totaling $9.6 billion. Additionally, short Bitcoin funds experienced $3.6 million in outflows, hinting at a drop in bearish sentiment among traders.

While Ethereum was the standout performer for inflows, other digital assets like Sui, Solana, and Chainlink also reported modest gains of $2.2 million, $1.5 million, and $0.8 million, respectively. Cardano saw a slight increase as well, with a mere $0.1 million in weekly inflows.

Conversely, XRP was the leader in outflows, losing over $28 million. Multi-asset investment products also faced $2.4 million in outflows during the same week.

Shifts in Investor Interest

There was a slight shift in investor focus away from the U.S., which still managed to secure $199 million in inflows last week. Germany followed with $42.9 million, while Australia attracted $21.5 million. Hong Kong made a significant mark by achieving its highest weekly inflow of $54.8 million since launching its exchange-traded products over a year ago. Canada reported $4.5 million in inflows.

In contrast, Switzerland experienced a setback, facing $32.8 million in outflows, making it one of the few regions with net outflows this year.

Post Comment