Is Bitcoin a Smarter Investment Now Compared to When It Reached $20K? (Legal Expert Weighs In)

Summary

-

Many consider Bitcoin’s present valuation to be a more secure investment compared to its previous level of $20,000, driven by expectations for increased fiscal deficits due to new governmental strategies and the growing interest from institutions and nations.

-

Indicators such as negative netflows from exchanges, a consistent MVRV ratio, and a record number of 55 million Bitcoin holders suggest promising prospects for price increases.

Is BTC a ‘Safer Purchase’ Now?

John Deaton, a lawyer who advocates for numerous XRP investors involved in a legal matter with Ripple, recently offered a thought-provoking perspective on Bitcoin.

He shared insights from David Bailey, the Chairman of Bitcoin Magazine, who encouraged investors to accumulate capital for buying Bitcoin.

While Deaton does not endorse the idea of borrowing money for cryptocurrency purchases, he believes that Bitcoin priced at $106,000 appears to be a “safer buy” compared to when it was at $20,000. He supports his viewpoint by highlighting the anticipated approval of certain economic measures, foreseeing that they could result in increased money supply and escalating debt levels.

He also mentioned that this situation, paired with fast-paced acceptance by institutions and governments, renders the current Bitcoin prices more favorable than they were at $25,000.

“I admit I have both confirmation bias and wealth-preservation bias,” Deaton noted.

Possible Price Increases Ahead?

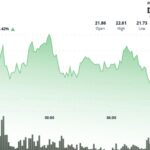

For some in the cryptocurrency sphere, Bitcoin trading above $100,000 still feels quite extraordinary, as many have been anticipating this threshold for several years.

Furthermore, several key indicators suggest that the cryptocurrency might see another price surge soon. The netflow metrics show a predominantly negative trend, indicating that investors are increasingly favoring self-custody over centralized exchanges. This shift reduces the immediate pressure to sell.

Another metric to consider is Bitcoin’s MVRV, which analyzes the relationship between its market capitalization and realized capitalization, assisting traders in determining whether the asset is fairly valued.

Recently, this ratio has been fluctuating between 2 and 2.5, indicating that appreciation potential still exists. According to historical trends, values above 3.70 have frequently indicated market peaks, while below 1 typically signifies a market bottom.

In addition, the total count of Bitcoin holders has recently surpassed 55 million, reflecting a notable increase in both adoption and demand for the asset.

Exclusive Offer: Register a new account to receive a special welcome bonus. (details are available).

Limited-time offer for readers: Open a trading position and receive credit!

Post Comment