Nasdaq Submits Application for 21Shares SUI ETF Listing, Initiating SEC Evaluation

Nasdaq has filed a 19b-4 application with the US Securities and Exchange Commission (SEC) to get approval for listing the 21Shares SUI ETF.

This submission, now accessible in the SEC’s public records, marks the start of the regulatory examination process and comes on the heels of 21Shares’ S-1 registration statement submitted in April.

Introducing SUI ETF to the American Market

The proposed ETF reflects increasing institutional interest in the Sui blockchain ecosystem, known for its efficient framework and developer-friendly qualities. 21Shares has already introduced a Sui exchange-traded product (ETP) in Europe, appearing on platforms like Euronext Paris and Amsterdam, and these offerings have witnessed a notable rise in investments recently.

According to the Sui Foundation, over $300 million has been earmarked for SUI-based investment products globally. Consequently, a successful launch in the US is anticipated to enhance access to the network and its digital currency. Interest in Sui has expanded beyond 21Shares, with entities such as Canary Capital, Franklin Templeton, VanEck, Grayscale, and Ant Financial engaging in various projects related to the ecosystem since late 2024.

Kevin Boon, President of Mysten Labs, stated,

“The Sui ecosystem has emerged as a leading choice for dedicated builders and institutions, and 21Shares has consistently recognized these trends early on. Reflecting on our mainnet launch just two years ago, achieving a NASDAQ filing is a significant milestone. We are excited to support 21Shares in working towards a future where every investor can access SUI.”

Performance of Sui in Q1

Sui’s decentralized finance (DeFi) ecosystem experienced notable growth in the first quarter, with an average daily volume of decentralized exchanges (DEX) hitting an all-time high of $304.3 million, marking a 14.6% increase from the previous quarter. Cetus and Bluefin were the leading platforms, while Kriya, DeepBook, and Turbos aided in enhancing liquidity.

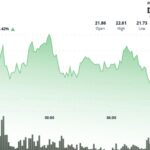

Despite this upward trend, the SUI token faced challenges, with its circulating market cap dropping by 40.3% to $7.2 billion, significantly outpacing the broader market’s 18.2% decline.

After a brief recovery in mid-May when it traded around $3.96, the token fell again due to heightened volatility, dropping below $3.00 in early June alongside a broader market downturn. However, it has recently experienced a resurgence, climbing back to roughly $3.50 by June 11.

Post Comment