Can They Ignite a Lasting Cryptocurrency Surge?

Analysts in the cryptocurrency field have consistently highlighted the necessity for enhanced liquidity to support an enduring price surge. Currently, the crypto landscape appears poised for substantial growth, largely attributed to the developments within the stablecoin sector.

A recent weekly analysis from CryptoQuant indicates that the market capitalization of stablecoins is on the rise, reaching all-time highs. This growth signifies an increase in liquidity within the cryptocurrency market, suggesting that more investment capital is becoming available for deployment.

Increase in Market Liquidity

As per CryptoQuant’s findings, the market capitalization of stablecoins has surged by 17% year-to-date, equating to an addition of $33 billion and bringing the total to an impressive $228 billion. Experts attribute this increase to the growing acceptance of stablecoins in payment processes, heightened trading activity in cryptocurrencies, and clearer regulatory guidelines in the United States, particularly during the previous administration.

Both Tether’s USDT and Circle’s USD Coin (USDC) have been significant contributors to the increase in stablecoin market capitalization. USDT’s market cap has expanded by 13% this year, reaching $155 billion, which translates to an increase of $18 billion.

In the same period, USDC has notably bounced back from setbacks experienced in March 2023 due to the collapse of Silicon Valley Bank amid the banking crisis in the U.S. Following this incident, USDC’s value fell below its peg, with its market cap dropping to approximately $24 billion. However, in 2025, USDC’s market cap has rebounded by 39% to $61 billion, gaining $17 billion.

Growth in Staked Stablecoins

Moreover, CryptoQuant reported a significant increase in the volume of stablecoins held on centralized exchanges (CEXs), reaching unprecedented levels. The total value of ERC20 stablecoins on these platforms is nearing $50 billion, with USDC accounting for a notable portion of this increase, as its exchange reserves have surged by 1.6 times to about $8 billion in 2025.

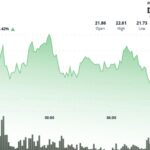

In addition to USDC’s growth, it was observed that the market value of yield-bearing stablecoins, which also serve as staked assets, has seen a resurgence, achieving levels not experienced since late March.

After dropping to a low point on May 23, the total worth of yield-bearing stablecoins has climbed by 28%, reaching $6.9 billion. Analysts noted that this recovery was significantly influenced by sUSDe, which grew by $1.23 billion, and sUSDs, which registered a 35% increase—equivalent to $0.7 billion—in market capitalization over the same timeframe.

Post Comment