How American Companies and Small Enterprises Are Boosting Crypto Adoption: Insights from Coinbase Research

More than 15 years have passed since the introduction of Bitcoin and blockchain technologies. In the last year, however, the cryptocurrency landscape has seen an unprecedented increase in adoption.

As outlined in a recent report by a digital asset exchange, the rise in stablecoins is largely attributed to their practical applications in payroll and remittances, driven by small business activities and institutional investments.

American Companies Adopt Cryptocurrency

The exchange carried out surveys targeting small and medium enterprises (SMEs) and institutional investors in early 2025. Findings revealed that actual crypto ownership is more prevalent than generally perceived, with an increasing number of institutions pursuing blockchain projects as part of their corporate agendas.

About 60% of executives from Fortune 500 companies indicated their organizations are engaged in blockchain initiatives. Approximately 47% of the participants disclosed that their firms have boosted investments in blockchain technologies. Additionally, the average number of blockchain projects per company has surged by 67% year-over-year, rising from 5.8 to 9.7.

The predominant types of blockchain projects among Fortune 500 companies include payment systems, international transfers, supply chain oversight, corporate treasury functions, and blockchain infrastructure development. The report noted that last quarter alone saw 17 distinct blockchain initiatives launched by Fortune 100 firms, with a total of 46 initiatives announced between the third quarter of 2024 and the first quarter of 2025. Companies from various sectors, including finance, technology, automotive, retail, food and beverage, and healthcare, are increasingly exploring diverse blockchain applications.

The Role of Regulatory Certainty

In examining small and medium businesses, the findings revealed that 34% currently utilize cryptocurrency, while 46% of those not yet involved are likely to begin within three years. A significant 82% of SMEs feel that cryptocurrencies could resolve some of their financial challenges.

According to the report, “2025 has proven to be a remarkable year for crypto adoption among SMEs,” with the number of businesses using cryptocurrencies and stablecoins doubling over the past year.

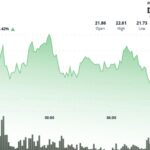

This growth in cryptocurrency usage has led to record levels of stablecoin transfer volumes. The industry experienced its two peak monthly organic transfer volumes in December 2024, totaling $719 billion, and in April 2025, reaching $717.1 billion.

Since 2019, the number of individuals holding stablecoins has expanded to over 160 million, surpassing the combined population of the ten largest cities globally and exceeding the 142 million users of the leading four mobile banking applications in the United States.

Furthermore, the exchange emphasized the importance of regulatory clarity in unlocking the full potential of cryptocurrency. A significant majority—90% of Fortune 500 executives and 72% of SMEs—echoed this sentiment, recognizing the need for clearer regulations.

Post Comment