Solana Block Traders Anticipate Continued Rise in SOL Token, Surpassing $200

SOL, the native cryptocurrency of the Solana blockchain, has experienced a significant increase over the past four weeks, rising by 85% since April 7—outpacing bitcoin by more than double. Large options traders are now betting on continued upward movement.

Recently, the token has reached approximately $176 as both cryptocurrency and traditional financial markets have taken on more risk. Bitcoin, the dominant cryptocurrency by market capitalization, has seen a 40% increase, according to recent data.

If the predictions of block traders—mainly institutional investors and participants making large trades outside of the public order book—hold true, these gains are set to persist. These traders have aggressively purchased June 27 expiry SOL $200 call options on Deribit, indicating their expectation that the price will surpass this mark by mid-year.

“Last week, traders initiated long positions on the $200 June call option. This transaction represented the largest block trade, totaling 50,000 contracts at a premium of $263,000,” noted Greg Magadini, director of derivatives at Amberdata, via email. On Deribit, a single options contract corresponds to one SOL.

A call option provides the buyer the right, not the obligation, to purchase the underlying asset at a specified price on a future date, indicating a bullish outlook. It’s akin to a lottery ticket, where the buyer risks only the initial investment for potentially substantial rewards.

Magadini pointed out that the call options were acquired at an annualized implied volatility (IV) of 84%. This suggests traders timed their purchases well, buying at lower prices since SOL’s IV usually stays in the triple digits.

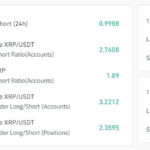

Data indicates that the demand for the $200 call option has left market makers with considerable net negative gamma exposure at that strike price.

Market makers facing negative gamma exposure generally buy as prices rise and sell during declines, striving for a delta-neutral position. Their hedging activities can exacerbate market fluctuations.

This suggests that volatility could increase as SOL moves toward the $200 threshold.

Post Comment