Bitcoin Projected at $400,000, Solana at $420, Sell ETH: Says Fund Manager

Reasons to Trust

A stringent editorial policy prioritizing precision, relevance, and neutrality.

Developed by specialists and thoroughly vetted.

Commitment to the highest standards in journalism and publishing.

A rigorous editorial policy emphasizing accuracy, relevance, and objectivity.

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a comprehensive discussion covering a range of topics from economic trends to the rise of meme currencies, seasoned trader Joe McCann, co-founder of Asymmetric, presented a compelling, albeit specific, argument. He forecasts that Bitcoin’s institutional investments could push it toward a price range in the high six figures, declaring that Solana is the preferred option for reaching a mid-three-digit valuation, while Ethereum is increasingly losing its investment allure.

Bitcoin to $400,000

McCann opened his analysis by addressing one of crypto’s most enduring beliefs. “It’s evident to anyone who follows the crypto space that the four-year cycle has essentially ended,” he commented to Scott Melker, suggesting that traditional post-halving patterns have been overshadowed by ETF inflows and what he describes as an “unprecedented market driven by headlines.”

He believes these inflows are only in their early stages. Sovereign funds, pension plans, and corporations are accumulating Bitcoin similar to how they once accumulated gold, but with a key difference: Bitcoin has a fixed supply. Amidst record-high uncertainty indices and U.S. trade policies influencing risk assets, McCann perceives a significant potential for price appreciation once “local maxima” regarding tariffs become clearer.

“If there’s deregulation and a softening of tariff policies, Bitcoin could potentially surge to two, three, or even four hundred thousand dollars. It really comes down to market flows.”

When asked about the timeline, McCann declined to provide a specific date. However, he detailed the dynamics: responsive price movements in a market with limited supply. Bitcoin, still just a fraction of gold’s market capitalization, operates in a context in which gold’s 40% rise this year has reawakened the narrative of Bitcoin as digital gold. A breakout of the Bitcoin-gold correlation to the upside could divert investment from gold simply due to Bitcoin’s transportability and resistance to censorship.

The suggestion is that crossing the psychological threshold of $100,000 could rapidly escalate to the target of $400,000 solely due to ETF demand—especially if the U.S. government implements initiatives like strategic Bitcoin acquisitions or proposals from lawmakers.

Future Prospects for Solana and Ethereum

If Bitcoin constitutes McCann’s primary investment, Solana serves as his high-confidence secondary choice. He highlights the network’s performance during the recent launch of a Trump-related meme coin, noting that “the chain functioned smoothly”—a testament to its scalability. Innovations like Moonshot wallets and the transition of stablecoin transactions from Ethereum, in his opinion, have minimized user experience challenges that held back the last market cycle.

“When the most famous individual globally introduces a meme coin on Solana, it signifies that we’re equipped for widespread adoption.”

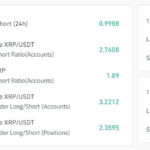

With Solana ETFs already operational in Canada and applications in the U.S. underway, he predicts that, “considering the fundamentals and ETF flows… Solana should reach at least $420,” a figure he has reiterated multiple times.

On the contrary, McCann’s hedge fund currently holds only one significant short position: Ethereum. He provided a straightforward explanation: once-groundbreaking technology is now being “undermined by its own layers.” With transaction fees averaging just one cent, revenue from gas fees fails to sufficiently reward holders, and institutional investors tend to favor assets that either generate cash flow or fit nicely within ETF structures—criteria Ethereum does not meet.

“The asset isn’t worth holding,” he concluded. “Whenever Ethereum ascends, it’s usually wise to take profits across the board.”

McCann expresses skepticism about the return of the indiscriminate “alt-season” that characterized previous highs. He argues that liquidity has split into Bitcoin ETFs on one side and high-volume meme-style platforms like Pump.Fun on the other. Cryptocurrencies positioned in between must now demonstrate “genuine protocol revenue, not merely governance.” If they can meet this benchmark, he anticipates a surge of dividend-oriented crypto ETFs aimed at yield-seeking investors; if not, “most will likely become worthless.”

At the time of reporting, Bitcoin was valued at $104,528.

Post Comment