US banking regulator paves the way for cryptocurrency services in national banks.

On May 13, the Office of the Comptroller of the Currency (OCC) declared that national banks are now permitted to engage in a broad spectrum of cryptocurrency activities, effectively eliminating longstanding regulatory uncertainties that had previously hindered many financial institutions from participating.

This regulatory change aligns with recent actions by the Federal Reserve and allows national banks to provide crypto custody services, execute trades as directed by customers, and delegate digital asset services in accordance with established third-party risk management guidelines.

OCC announcements and letters

The OCC communicated this shift through a formal statement and the issuance of Interpretive Letters 1183 and 1184, collectively indicating a systematic relaxation of previous prohibitions.

Letter 1183, released on March 7, officially revokes the 2021 supervisory “non-objection” protocol outlined in Letter 1179, simultaneously withdrawing the OCC from two interagency statements issued in 2023 that highlighted the risks associated with cryptocurrencies.

Letter 1184, published on May 7, broadens authority by allowing banks to trade cryptocurrencies in their custody at client request and to engage sub-custodians, provided that risk management protocols adhere to conventional financial outsourcing standards.

These regulatory adjustments are in sync with the Federal Reserve’s decision on April 24 to eliminate its prior pre-approval requirement for crypto activities applicable to state-chartered member banks.

Cumulatively, these initiatives by the OCC and the Fed eliminate key regulatory barriers that have hindered the widespread adoption of cryptocurrency services among traditional financial institutions.

The OCC reassured that the U.S. banking sector is now “well-positioned” to facilitate digital asset activities, as long as these operations remain “safe, sound, and fair.”

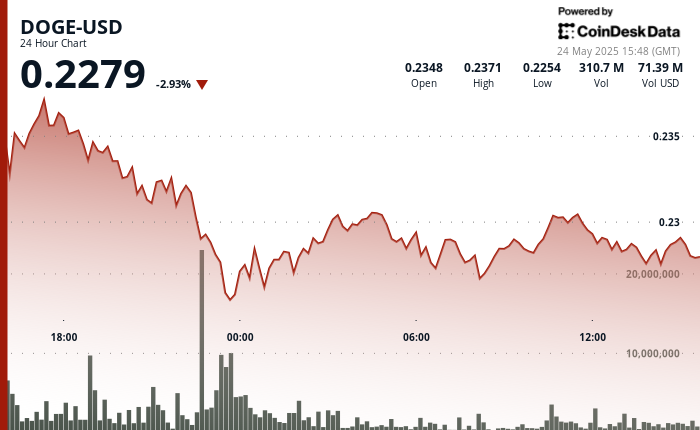

This decision mirrors shifting market dynamics and escalating consumer demand. As reported in an April 2025 survey, about 55 million Americans, equating to roughly 21% of the adult population, are cryptocurrency owners.

Future of crypto within US TradFi Sector

With a global cryptocurrency market capitalization of approximately $3.33 trillion as of May 13, the opportunity in this space is no longer seen as speculative. For national banks, entering the cryptocurrency market presents a viable avenue to capture custody fees, transaction income, and enhance customer loyalty in an arena predominantly led by fintech and crypto-focused enterprises.

The OCC highlighted the growing permanence of digital financial services. “More than 50 million Americans possess some form of cryptocurrency,” stated Acting Comptroller Rodney E. Hood. “The digital transformation of financial services is not merely a trend; it is a fundamental shift.”

This characterization of the transition as a structural transformation rather than a fleeting surge indicates the agency’s intent to nurture integration within established banking frameworks rather than foster isolated experimentation.

While national banks now have federal authorization, they still face implementation hurdles.

Next steps

Letters 1183 and 1184 emphasize the importance of adhering to anti-money laundering (AML) provisions and other regulatory obligations, yet they lack detailed instructions regarding specific issues like private key management or capital adequacy requirements.

The incorporation of necessary wallet infrastructure, AML measures, and agreements with third-party service providers is expected to take several months. Industry projections indicate that major national banks may require between six to twelve months to roll out comprehensive cryptocurrency services.

Further uncertainty persists about the classification of various digital assets. The ongoing jurisdictional dispute between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) suggests that certain tokens may remain in regulatory limbo.

Additionally, although banks will be able to offer crypto custody, the FDIC does not insure digital assets, an important consideration for how banks communicate with customers and in their marketing materials.

Nevertheless, the regulators’ alignment towards a more permissive stance signifies the most substantial transformation in U.S. banking policy regarding cryptocurrencies since the OCC’s 2020 Letter 1170, which first allowed national banks to hold digital assets.

The newly issued guidance not only replaces previous restrictions but also adjusts U.S. financial oversight to align more closely with ongoing adoption trends observed in Europe and Asia, where regulated cryptocurrency services have already gained entry into institutional markets.

This policy evolution occurs amid political advocacy to end the perceived de-banking of crypto companies and to promote broader innovation objectives.

Claims suggesting that regulators had engaged in a coordinated strategy, often referred to as “Operation Chokepoint 2.0,” to restrict crypto’s access within the banking system, have gained traction in recent years. The concurrent policy reversals from the OCC and Fed may be viewed as efforts to mitigate those criticisms and align with the pro-innovation narrative of the current administration.

As Letters 1183 and 1184 are implemented, competition in the custody and trading space is likely to heighten.

Traditional banks, bolstered by their established client bases and regulatory frameworks, are positioned to challenge crypto-native firms directly. Given that consumer confidence in traditional banks remains higher than in exchanges, especially following the events of 2022, established institutions could potentially gain momentum quickly.

However, the success of these banks will depend on their ability to efficiently convert regulatory approval into operational capability.

Post Comment