Are Bitcoin Whales Ready to Sell? Crucial Indicator Suggests Potential Profit-Taking on the Horizon

Reasons to Trust

Unwavering commitment to accuracy, relevance, and neutrality in reporting

Developed by experts and thoroughly evaluated for quality

Upheld the highest benchmarks in reporting standards

Unwavering commitment to accuracy, relevance, and neutrality in reporting

The quality of information is ensured through meticulous evaluations.

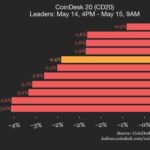

Recent fluctuations in Bitcoin’s market indicate a continued upward trend, despite some short-term volatility. Presently, BTC is priced at $103,485, reflecting a minor decrease of 0.6% in the past 24 hours and a nearly 10% decline over the previous week.

Nonetheless, this cryptocurrency remains approximately 5% below its peak value of $109,000 achieved in January, maintaining a robust position close to record highs. This trend may indicate that Bitcoin is entering a consolidation period, buoyed by overarching positive fundamentals.

The renewed engagement from long-term holders is creating speculation about the durability of the current price zone and the likelihood of future market fluctuations.

Further Reading

Bitcoin Binary CDD Indicates Possible Market Shift

Analyst Avocado Onchain from CryptoQuant recently pointed out a significant metric known as Binary Coin Days Destroyed (CDD), which assists in analyzing the behavior of long-inactive Bitcoins. An increase in Binary CDD occurs when older coins are transacted after long periods of dormancy, often indicating that long-term holders are either re-entering the market or preparing to liquidate their assets.

Historically, surges in Binary CDD have aligned with market peaks or periods of redistribution from early adopters to newer investors. Avocado suggests that using a 30-day moving average for Binary CDD provides a smoother trend analysis and reveals macro trends more clearly.

During past Bitcoin surges, particularly in late 2021 and during 2024’s twin peaks, Binary CDD exceeded the 0.8 mark. Historically, this level has indicated substantial movement from long-term holders, often correlating with increased selling pressure or profit-taking.

Currently, the metric sits near 0.6 and is on an upward trajectory as Bitcoin seeks to challenge its previous highs. If Binary CDD surpasses 0.8 again, it could suggest a new wave of asset distribution is in progress.

Observing Profit Taking Patterns

The strength of Binary CDD lies in its capacity to indicate potential market structure changes. When significant amounts of BTC are moved by long-term holders, it frequently signals the initiation of profit-taking, especially when accompanied by elevated prices and favorable market sentiments.

However, it is essential to interpret this indicator within context, taking into account elements like exchange inflows and broader trading activity.

In a wider perspective, the recent increase in Binary CDD may imply Bitcoin is transitioning into a new phase. Instead of marking the conclusion of an upward trend, it might suggest that prominent investors are reallocating their assets or reacting to price movements ahead of imminent adjustments.

Separately, another CryptoQuant analyst, EgyHash, has raised concerns related to the Exchange Stablecoins Ratio (USD), which compares Bitcoin reserves to stablecoin inventories on exchanges.

EgyHash reports that this ratio has risen to approximately 5.3, breaching the 5.0 level that has historically preceded market distribution phases.

A similar situation noted in late January resulted in a market correction, and the current figure suggests more traders might be gearing up to sell, possibly reallocating BTC holdings into stablecoins or fiat currencies.

Post Comment