Scandals Involving Mantra (OM) and Movement Labs (MOVE) are Disrupting the Crypto Market-Making Landscape

Two of the year’s most turbulent token events — the Movement Labs’ MOVE incident and the downfall of Mantra’s OM — are causing significant disruptions in the crypto market-making industry.

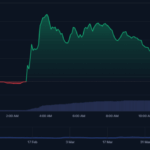

In both scenarios, swift declines in prices uncovered hidden players, dubious token unlock timelines, and purported agreements that kept market participants in the dark, with OM plummeting over 90% within a few hours in late April without any clear trigger.

In contrast to conventional finance, where market makers create orderly bid-ask spreads in regulated environments, crypto market makers often function more like high-stakes trading operation centers.

Their role extends beyond just quoting prices; they negotiate pre-launch token distributions, agree to lock-up periods, structure liquidity for centralized exchanges, and may even take equity stakes or advisory roles.

This creates a complex environment where the provision of liquidity is intertwined with private agreements, tokenomics, and sometimes, the politics of insider knowledge.

A recent investigation revealed that certain executives at Movement Labs colluded with their market maker to offload $38 million worth of MOVE publicly.

This has led some firms to reconsider their approach toward trusting counterparties. Questions arise: How can one hedge a position when token unlock schedules lack transparency? What occurs when informal agreements bypass DAO decisions?

“Our strategy now incorporates more comprehensive initial discussions and educational sessions with project teams to ensure they grasp market-making processes,” stated the market-making division of Metalpha, based in Hong Kong.

The firm further explained, “Our deal frameworks have shifted to prioritize long-term strategic alignment over immediate performance benchmarks, implementing specific protections against unethical actions like excessive token sales and artificially inflated trading volumes.”

Behind the scenes, discussions are intensifying. Deal terms are being analyzed with greater scrutiny. Several liquidity desks are reassessing their approaches to evaluating token risk.

Others are insisting on higher levels of transparency — or completely withdrawing from unclear projects.

“Projects are no longer assuming prominent reputations implicitly, realizing that even well-established entities can misuse hidden allocations or engage in harmful token selling practices,” observed Max Sun, the head of Metalpha’s Web3 ecosystem. “The era of presumed trust has ended,” he asserted.

Beyond the polished presentations of token launches and market-making agreements lies another facet of cryptocurrency finance — the unregulated over-the-counter (OTC) market, where locked tokens are traded quietly before vesting periods become public knowledge.

These covert transactions, typically involving early backers, funds, and syndicates, are now distorting supply dynamics and complicating price discovery, according to some traders. For market makers responsible for ensuring orderly liquidity, these situations are becoming increasingly unclear and risky.

“The secondary OTC market has transformed the industry’s dynamics,” commented Min Jung, an analyst at Presto Research, which operates a market-making unit. “Tokens exhibiting suspicious price behaviors — like $LAYER, $OM, $MOVE, among others — are frequently those actively traded in the secondary OTC market.”

“The entire supply and vesting framework has become skewed due to these off-market transactions, making it difficult for liquid funds to ascertain when supply will actually become available,” Jung added.

In a fluctuating market where prices are essentially fictitious and supply is arranged in private discussions, the real threat for traders isn’t merely volatility — it’s in assuming that the circulating supply matches what the whitepaper or founders stipulate.

Post Comment