Ethereum Encounters Pushback from Bitcoin – Is the ETH/BTC Bullish Trend at Risk?

Why You Can Trust Us

Commitment to editorial standards emphasizing precision, relevance, and neutrality

Developed by field specialists and thoroughly vetted

Adherence to top-tier journalism and publication principles

Commitment to editorial standards emphasizing precision, relevance, and neutrality

A balanced approach to market trends and insights.

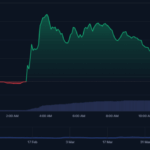

After a notable surge that took Ethereum to a local peak of $2,730, it has now seen a drop of over 10%, currently testing important support levels as the market stabilizes. This correction follows a phase of significant buying activity and rising hopes for an overarching altcoin season. The recent decline has triggered discussions among traders and analysts, creating a divide between those expecting another upward movement and those bracing for a deeper market pullback.

Some market participants consider this pause as a beneficial and necessary adjustment before Ethereum can continue its ascent. Conversely, others caution that ETH may revisit lower price zones, particularly if Bitcoin remains stagnant. Analyst Daan has highlighted the ETH/BTC trading pairing, indicating that Ethereum is encountering resistance around the 0.026 BTC mark following its substantial upward movement.

With Ethereum still trading well below its all-time peak and within a broad macro trading range, the next few days will be crucial. Whether this episode is merely a brief adjustment or the onset of a more severe correction, Ethereum’s current price levels will likely influence the momentum as the market transitions into the next phase.

Ethereum Maintains Essential Support Amid Resistance on ETH/BTC Pair

Ethereum demonstrates notable resilience in the face of recent fluctuations, consistently staying above the $2,400 level. This range now serves as critical support that bulls must defend to maintain the overall bullish trend. Although price actions have cooled slightly after the spike to $2,730, ETH continues to be one of the more robust assets in the ecosystem, holding steady amidst heightened uncertainty and speculative activities.

A significant portion of the ongoing optimism centers on Ethereum’s performance in relation to Bitcoin. If ETH maintains its outperformance against BTC, analysts speculate it could initiate the long-anticipated altcoin season, wherein altcoins markedly outperform Bitcoin. Daan provided insights on this relationship, emphasizing the strengthened ETH/BTC ratio observed in recent trading sessions.

According to Daan, ETH has encountered resistance around the 0.026 level after its rapid rise. To sustain positive momentum, ETH must remain above the 0.0224 threshold. A drop below this crucial support could lead to a gradual decline, potentially reversing the recent gains. Alternatively, a decisive breakthrough above 0.026 could pave the way for a move towards 0.03 and higher.

In essence, Ethereum’s short-term trajectory is likely to be influenced by its ability to uphold the $2,400 level and its strength in relation to Bitcoin. Meeting both criteria would significantly bolster the case for a sustained altcoin rally.

ETH Retraces to Support After Rejection Near $2,700

Currently valued at $2,485, Ethereum has retreated sharply from its recent local high of approximately $2,730. The data indicates that ETH was unable to maintain its position above the 200-day simple moving average (SMA) at $2,701, which presented a formidable resistance area. Following an extended period of upward momentum, this rejection has guided the price back towards the 200-day exponential moving average (EMA) around $2,438 — a pivotal level acting as immediate support.

High volume persists during this transition, indicating active engagement from both buyers and sellers. Despite the setback from the 200 SMA, Ethereum is still significantly above its breakout level from early May, marked by a surge from below $2,000. If buyers can protect the EMA and sustain prices over $2,400, it could establish a higher low, setting the groundwork for another attempt at reclaiming the $2,700–$2,800 range.

Should Ethereum fall below the $2,400 mark, the momentum may shift toward bearish sentiment, leading to a potential larger correction. At this time, Ethereum remains within a consolidation phase while still aligning with an overall bullish trend. The upcoming daily closes will be pivotal in determining whether this pullback is a healthy correction or an indication of deeper vulnerabilities.

Post Comment