Dogecoin’s Momentum Slows – Expert Anticipates Return to $0.213

Reasons to Trust

Adherence to a rigorous editorial policy that prioritizes precision, relevance, and neutrality.

Developed by professionals within the industry and thoroughly evaluated.

Commitment to upholding the highest standards in news reporting and publication.

Adherence to a rigorous editorial policy that prioritizes precision, relevance, and neutrality.

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin is currently at a pivotal moment, trading below the $0.26 resistance level, after facing increased selling pressure due to a significant rejection last week. Following a local peak on May 10th, the price of DOGE has fallen by more than 18%, retracing part of its notable rally that began in early April. After a strong surge past $0.13, which represented a 100% increase in under a month, recent trading patterns indicate a potential slowdown.

The market is closely monitoring whether Dogecoin can maintain its current levels or if further declines are imminent. Analyst Ali Martinez suggests that the recent rejection could lead to a retest of the $0.213 mark, a crucial level that has historically functioned as both resistance and support. If bullish momentum continues to wane, this level could attract the price downwards.

Despite a cautious sentiment, future price movements will hinge on the ability of bulls to regain control or whether DOGE breaks below its recent trading range. The upcoming days could significantly influence Dogecoin’s mid-term trajectory, with expected volatility increases.

Speculation Grows as DOGE Faces a Key Challenge

In the recent market correction that impacted the crypto landscape, meme coins like Dogecoin were among the most adversely affected. As Bitcoin and other major altcoins experienced steep declines, DOGE saw a sharp pullback, losing over 18% since May 10th and erasing a substantial portion of its earlier gains. This downturn disrupted the bullish trend that emerged after DOGE rallied more than 100% starting in early April, following the breakout above the $0.13 threshold.

Even with the drop, speculation regarding Dogecoin’s potential leadership position remains strong if the market regains momentum. Historically, DOGE has been a high-volatility asset, often outperforming during bullish cycles. As the broader market seeks stability, some analysts believe DOGE could benefit if sentiment shifts back to a bullish outlook.

Nonetheless, risks persist. The price is hovering just above significant support levels, and failing to maintain this area could lead to a more profound retracement. Martinez has articulated a technical perspective indicating that if the current levels do not hold, Dogecoin may revisit the $0.213 mark, which previously served as a launch point during the April surge.

The next few trading sessions are likely to be critical. The narrative around meme coins could regain traction if bulls manage to push DOGE back towards the $0.26 resistance. Conversely, if bearish forces strengthen and DOGE breaks downwards, it would indicate a continuation of the current downward trend. All eyes are on this crucial support level as Dogecoin navigates through a complex market environment.

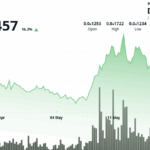

Technical Overview: Dogecoin Facing Important Demand Levels

Dogecoin (DOGE) is currently showing signs of vulnerability after struggling to stay above key resistance around $0.26 earlier in the month. The daily price chart reveals DOGE trading at approximately $0.221, consolidating just above the 200-day EMA ($0.219) and below the 200-day SMA ($0.269). This zone has become a battleground between buyers and sellers, with recent candlesticks reflecting indecisiveness due to their compact structures.

Trading volume has noticeably decreased since the early May breakout, indicating a potential reduction in trader engagement and momentum. If DOGE fails to hold the support range around $0.219–$0.220, the next significant support level is around $0.213, which aligns with concerns voiced by analysts about a possible retest of that mark. A drop below this range could lead to further declines toward the $0.19 level.

Outlook on the Market

On the upside, regaining the 200-day SMA at $0.269 would serve as a strong bullish indicator, as it would position DOGE above important long-term resistance. However, the prevailing trend suggests a measured approach, especially amidst broader market uncertainty and diminished sentiment among altcoins. Overall, the chart points to a stall in bullish momentum and an increased risk of a deeper correction unless DOGE can strengthen above essential moving averages. The next days will be crucial in determining whether the consolidation continues or escalates into a full-scale correction.

Image credits from Dall-E, chart data sourced from TradingView.

Post Comment