$3.8 Billion in Capital Investments Fuel Ethereum’s Surge Following the Pectra Event, New Data Reveals

Why You Can Rely on Us

Impartial editorial guidelines emphasizing precision and relevance

Developed by experts and thoroughly vetted for accuracy

Upholding the highest standards in journalism and publication

Impartial editorial guidelines emphasizing precision and relevance

The market’s dynamic nature has a significant impact on trends.

Recent blockchain metrics indicate that Ethereum’s Realized Cap has experienced a notable surge, suggesting fresh investment into the asset.

Ethereum’s Realized Cap Recently Reached $244.6 Billion

In a recent announcement, the on-chain analysis company noted a shift in Ethereum’s Realized Cap following the Pectra upgrade. This upgrade, implemented on May 7th, brought several enhancements to the Ethereum network, such as improved staking mechanics and expanded transaction capacity.

Additional Insights

The data presented shows a correlation between the upgrade’s implementation and an uptick in the cryptocurrency’s Realized Cap.

The Realized Cap is a capitalization model based on blockchain data, determining Ethereum’s total value under the assumption that the valid market price of each circulating token is equal to the last recorded transaction price.

This model effectively aggregates the purchase price for all Ethereum tokens in circulation, reflecting the total capital invested by market participants.

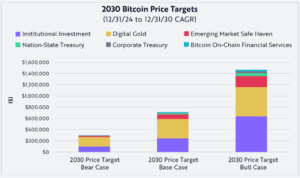

The graph illustrates that the Realized Cap peaked in early February before undergoing a downturn. A declining value in this metric typically indicates capital exiting Ethereum.

A period of capital outflows lasted for about three months, during which the asset’s price also declined. Nonetheless, post-Pectra upgrade, a new upward trend in Realized Cap has emerged.

At the time of the upgrade, this indicator was recorded at $240.8 billion. Currently, it has risen to $244.6 billion, indicating an influx of approximately $3.8 billion, or a 1.6% increase, into Ethereum.

In tandem with this capital influx, the value of Ethereum has surged from $1,800 to roughly $2,500. The sustainability of this uptrend in Realized Cap remains to be seen.

Although the capital inflow situation has improved following the Pectra upgrade, network activity has not shown similar signs of growth, as noted in another recent post by the analysis firm.

Since the upgrade, the average number of new and reactivated addresses has decreased compared to year-to-date figures (–1.8% and –8.4%, respectively), while the churn rate has also declined significantly (–8.5%), according to the analytics firm. Reactivated addresses refer to those previously inactive that have started to engage with the network again, while churned addresses represent those that were once active but have become dormant.

Additional Insights

These patterns suggest that while the upgrade has not drawn in new or returning users, it has fostered greater interaction among current Ethereum users, resulting in a lower churn rate.

ETH Value

As of now, Ethereum’s trading price is approximately $2,500, reflecting a decrease of over 4% over the past week.

Featured image from Dall-E, chart from Market Analysis

Post Comment