Bitcoin Displays High Unrealized Gains Amidst Absence of Panic Selling

Reasons to Rely On Us

Our editorial guidelines emphasize precision, relevance, and objectivity.

Crafted by specialists with thorough evaluation.

Upholding the highest standards in journalism and publication.

Our editorial guidelines emphasize precision, relevance, and objectivity.

This includes careful consideration and analysis of all information shared.

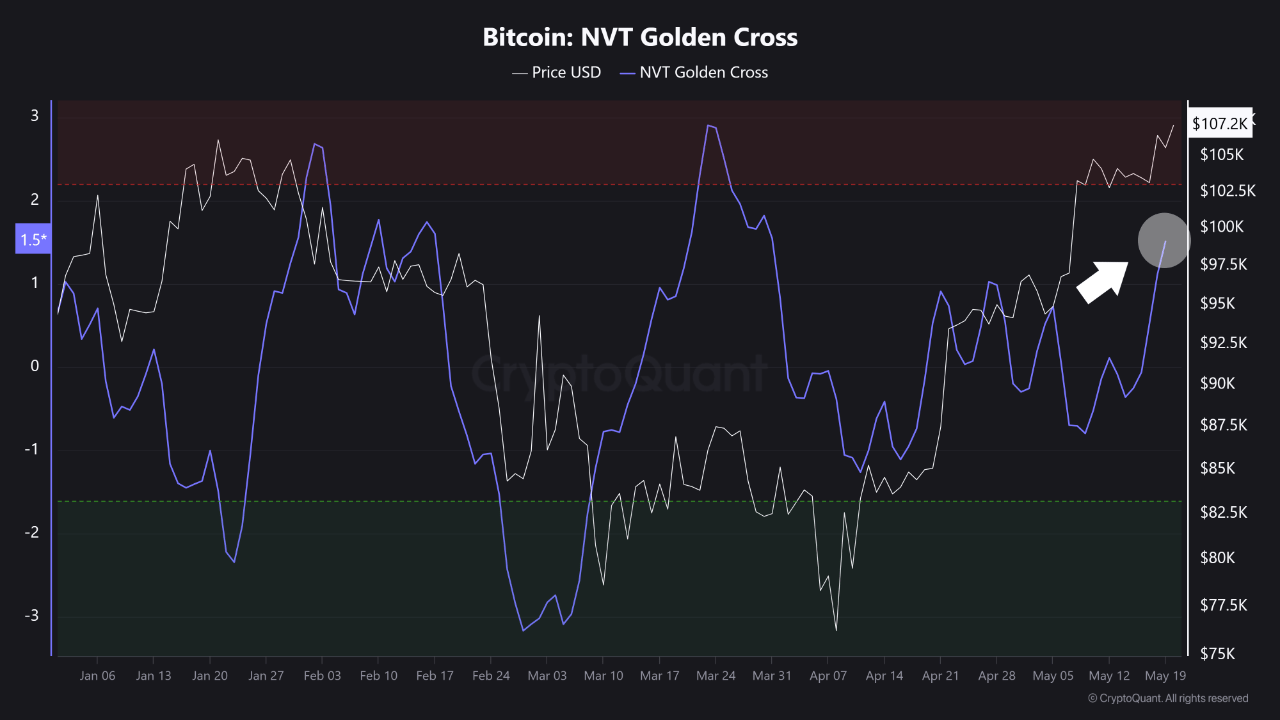

Bitcoin (BTC) has surged over 22.5% in the past month, raising worries in the crypto sector that its upward trend might be slowing down, potentially leading to a price pullback. Nevertheless, the latest on-chain metrics indicate that, although unrealized profits are high, selling pressure remains absent for the dominant cryptocurrency.

Bitcoin’s Unrealized Gains Are Substantial, Yet No Signs of Panic Selling

As per a recent analysis by Bitcoin analyst Crazzyblockk, those who are new investors—holding BTC for less than a month—are currently experiencing unrealized profits of 6.9%.

Additional Insights

Similarly, short-term investors who have held Bitcoin for under six months are sitting on unrealized gains of 10.7%. This data points to a favorable unrealized profit/loss ratio, where profits greatly exceed losses.

Crazzyblockk observed that historically, a high level of unrealized profits across the network often occurs before significant price drops. However, the current situation seems to be different. They commented:

Previous trends indicate that a high concentration of profits often results in volatility; nonetheless, the current market landscape does not exhibit notable risk concentration among various participants.

The minor disparity in unrealized profits among new and short-term investors suggests a balanced distribution of profits. Additionally, while profit levels are substantial, losses are constrained, indicating that pressure from sellers in distress is limited. The analyst noted:

Despite elevated macro conditions and risk of volatility, the lack of behavioral signals indicates that there is not a strong inclination to trigger significant selling.

Is There More Upside for BTC?

In a related perspective, crypto analyst Ali Martinez has recently forecasted further growth for Bitcoin. In a statement on X, Martinez pointed out that BTC has experienced another bullish breakout, potentially leading it to a new all-time record near $111,500.

This recent momentum has also attracted retail investors. As noted by CryptoQuant contributor Carmelo Aleman, smaller wallets holding under $10,000 in BTC are consistently returning to the market, indicating a rise in retail activity.

Additional Insights

However, there are still cautionary signals that could hinder BTC’s ongoing bullish trend. For example, despite a recent uptick in prices, Bitcoin’s Demand Momentum remains relatively low.

In addition, the concept of Bitcoin’s “supply scarcity” has not gained substantial traction, as Aleman has pointed out that even though exchange reserves are decreasing, Bitcoin isn’t anticipated to experience true supply scarcity in the immediate future. Currently, BTC is trading at $106,528, reflecting a 1.8% increase over the last 24 hours.

Post Comment