Solana’s BONK Aims for 77% Recovery Following Drop to 200 EMA

Reasons to Trust

Comprehensive editorial guidelines that prioritize accuracy, relevance, and neutrality

Developed by professionals in the field and rigorously evaluated

Adheres to the highest reporting and publishing standards

Comprehensive editorial guidelines that prioritize accuracy, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

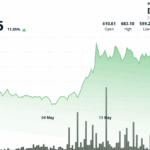

The price movements of BONK in May have been quite volatile, and the cryptocurrency is currently close to its starting point for the month. Recent trends indicate that the token is attempting to find stability around the 200 EMA after facing resistance near the 0.00002581 mark.

This resistance triggered a noticeable retreat to about $0.00001820. However, insights from technical analysis on the TradingView platform suggest that this pullback is shaping up to be a bullish continuation setup, indicating a possible 77% recovery instead of signaling a bearish trend.

Bullish Structure Remains Strong for BONK

The recent price retreat has landed BONK in a significant technical zone. Central to this area is the 200 EMA on the 4-hour chart, which may act as the next support level for the cryptocurrency as it advances. Additionally, this retracement coincides with the 0.618 Fibonacci level, often linked to bullish corrections. It also aligns with a daily support range between $0.00001832 and $0.00001841, alongside a resistance threshold at approximately $0.00002034.

Related Insights

Curiously, this pattern has resulted in a consolidation phase between these price points since May 15, with analysts noting that the structure suggests buyers are entering the market to maintain the trend, resulting in a higher low formation.

From a volume perspective, each upward movement has shown increasing volume since early April. Conversely, the recent downward trend has occurred with lower volume, suggesting that sellers might be losing momentum.

Potential for a 77% Upswing if BONK Breaks Resistance

Despite the current trading range, BONK remains in a bullish formation that could propel it toward new highs for 2025 and potentially revisit all-time highs. The critical level to monitor now is the point of control (POC) resistance, situated around $0.00001955. This level previously acted as a pivot point prior to the pullback and is crucial for confirming bullish continuation.

Related Insights

A confirmed closure above this resistance level is likely to catalyze a swift move towards the next resistance cluster at approximately $0.00002581, eventually targeting a projected price of $0.00003243, which would bring it near its opening price of January 2025 at $0.000035. This anticipated move would equate to a 77% increase, which aligns with previous swing highs observed on January 15 and January 18.

As of now, BONK is trading at $0.00001995, showing a 1.6% increase within the last 24 hours. Its performance right above the POC resistance will be critical for determining future actions. If buyers can maintain momentum and execute a decisive breakout, it may pave the way for a significant uptick into the higher resistance levels and a retest of BONK’s 2025 swing high.

Image credit: Shutterstock, chart reference

Post Comment