Positive Developments for XRP and DOGE? Coinbase Launches Wrapped Tokens on Base Network

Coinbase, the leading cryptocurrency exchange in the United States, has introduced wrapped versions of XRP and Dogecoin on its Ethereum layer-2 platform named Base.

The Coinbase Assets X account shared via a series of tweets that the exchange maintains a 1:1 reserve for the original assets backing cbXRP and cbDOGE, securely held in its custody.

Launch of cbXRP and cbDOGE on Base

The introduction of wrapped tokens for XRP and DOGE is designed to facilitate cross-chain capabilities. Investors can now utilize cbXRP and cbDOGE to engage with various applications on the Base network.

As of now, Coinbase has created 10.4 million cbDOGE, which is valued at around $1.88 million based on Dogecoin’s current market price. Additionally, the exchange has released at least 2.3 million cbXRP, amounting to over $5 million in value. To help users avoid scams, Coinbase has made the Base contract addresses for both cbXRP and cbDOGE publicly available.

cbXRP and cbDOGE are now part of the expanding range of wrapped assets available on the Base network. Earlier, Coinbase launched Wrapped Bitcoin (cbBTC) and Wrapped Ether (cbETH), with plans to introduce similar wrapped versions for Cardano (ADA) and Litecoin (LTC) in the near future.

Coinbase’s Achievements and Obstacles

Since last year, Coinbase has been actively broadening its portfolio of wrapped tokens, particularly after the successful rollout of cbBTC. This product debuted on Base and Ethereum in mid-September 2024, quickly becoming the third-largest wrapped Bitcoin variant within a week, maintaining a market cap of at least $4.7 billion—second only to Binance’s wrapped BTC and BitGo’s WBTC.

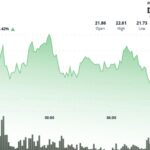

This significant achievement follows Coinbase’s inclusion in the S&P 500 stock index, a landmark event as it is the first crypto entity to reach this benchmark. Furthermore, the company has recently agreed to acquire Deribit, the leading crypto derivatives exchange, for $2.9 billion.

Despite these accomplishments, Coinbase is also facing some difficulties. The exchange has experienced a substantial data breach impacting approximately 69,000 users, which compromised user data and the company’s support systems, resulting in potential losses of up to $400 million. As Coinbase addresses this issue, it is facing heightened scrutiny for its initial decision not to disclose the breach as soon as it was detected.

Post Comment