Centralized Bitcoin (BTC) Reserves Nearly Account for One-Third of Overall Supply

Centralized Bitcoin reserves now constitute 30.9% of the overall circulating supply, based on recent findings from Gemini. This concentration involves 216 entities, which encompass governments, exchange-traded funds (ETFs), public and private firms, centralized exchanges, and decentralized finance contracts, reflecting a trend toward greater institutional involvement and development.

The total Bitcoin held by significant institutional and custodial bodies has surged to 6,145,207 BTC, representing an impressive 924% growth over the last ten years. This significant increase illustrates how centralized entities have gradually secured a larger portion of the network’s total supply, altering the ownership landscape of Bitcoin to favor institutional players.

Market Development

A collaborative report from Gemini and Glassnode reveals that merely three entities lead in Bitcoin adoption across various institutional sectors, possessing between 65% and 90% of the total BTC. This level of concentration highlights how early adopters have influenced both the strategic path and the credibility of Bitcoin within the realm of institutional finance.

Conversely, holdings by private companies exhibit a more balanced distribution, suggesting wider acceptance at that level. While the substantial concentration may lessen as institutional involvement broadens, the initial leaders continue to play a crucial role in attracting capital and reinforcing Bitcoin’s status as a significant macro asset in conventional finance.

The custody landscape has gradually transitioned from centralized exchanges toward ETFs, funds, and DeFi protocols, which have become primary access points for the spot market. Although balances on centralized exchanges have diminished over the last two years, this does not imply a scarcity in supply.

Rather, a significant portion of Bitcoin has transitioned into custodial frameworks, particularly US spot ETFs. The cumulative assets held by these custodians have remained surprisingly stable, fluctuating between 3.9 million and 4.2 million BTC since June 2021. This trend indicates a reallocation rather than a decrease in the available supply.

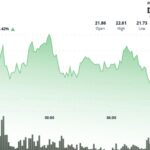

Despite the steady total of holdings, these custodians significantly affect price movements, given their responsiveness to market changes. Monthly capital flows can vary drastically, reaching swings of up to $10 billion, positioning these entities as key factors in Bitcoin’s immediate market performance, all while the structure of the spot market becomes increasingly institutional and regulated.

National BTC Reserves

Government-held Bitcoin reserves have seen substantial growth, especially in the US, China, the UK, and Germany, with most acquisitions occurring through legal seizures rather than market transactions.

The US is notable for possessing over 200,000 BTC, primarily obtained from significant law enforcement seizures. This includes 69,369 BTC from the Silk Road case in November 2017 and 94,643 BTC retrieved from the Bitfinex hack in February 2022.

Following a brief downturn, a segment of the US government’s remaining balance was officially designated as a Strategic Bitcoin Reserve (SBR) after an executive order from President Donald Trump on March 6th.

In the UK, Bitcoin has been confiscated by the National Crime Agency in operations targeting cybercriminals. After banning cryptocurrency activities, China seized over 194,000 BTC in November 2020 during its crackdown on the PlusToken Ponzi scheme.

Germany similarly acquired Bitcoin through criminal investigations but liquidated all its holdings by April 29th. These government reserves represent a unique segment in the cryptocurrency landscape: largely inactive, yet capable of impacting the market if liquidated.

Post Comment