Gold Prices Approach Record Levels Amid Concerns of Widening Conflict in the Middle East

The price of gold is edging closer to its historic peak of $3,433, which fuels its ongoing upward trajectory in 2025, largely driven by rising tensions in the Middle East that prompt a shift towards traditional safe-haven investments.

This rise in gold prices is indicative of both geopolitical instability and a significant change in global reserve asset allocation. Recent reports indicate that gold surpassed the euro in 2024, becoming the second most essential reserve asset globally, spurred by unprecedented central bank acquisitions.

Over the past month, the spot price of gold has increased by almost 5%, recovering from a low of about $3,123 seen in mid-May. It surged 1.6% overnight, exceeding $3,400 and edging closer to the April record of $3,500. So far this year, gold has appreciated by over 30%, establishing it as one of the top-performing asset categories in 2025.

Geopolitical tensions drive gold prices upward

The primary factor behind the recent rise in gold prices is the increased tensions in the Middle East, particularly following military actions against Iran’s nuclear facilities. Concerns about a potential escalation into wider regional conflict are making investors seek refuge in gold.

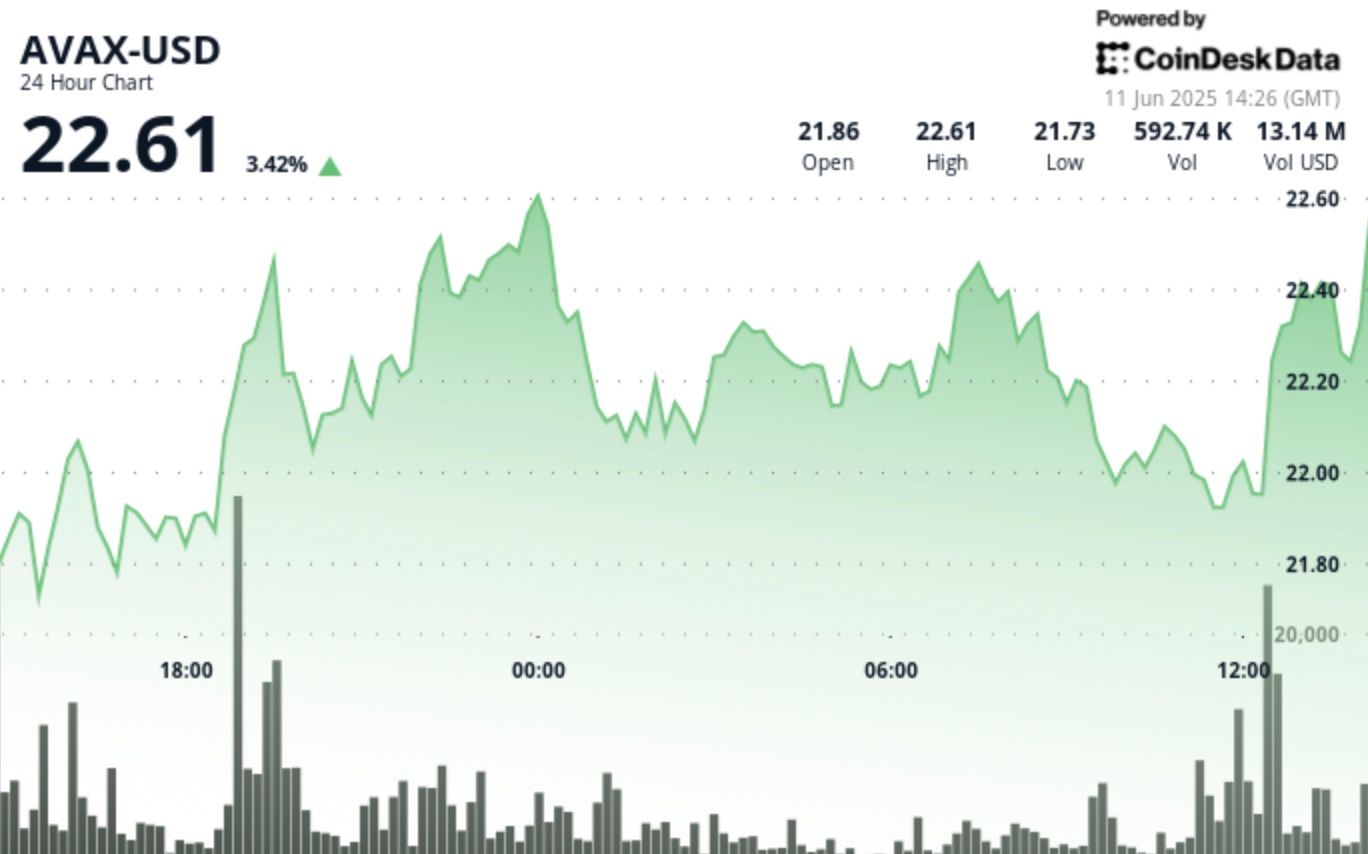

The Dow Jones Industrial Average dropped by 679.83 points, while the S&P 500 fell by 1.13%, coinciding with a 7% spike in oil prices in a single day, marking the most significant intraday increase since the early period of the Ukraine conflict. Bitcoin experienced a temporary drop but managed to recover to $105,000 at the time of this report, indicating relative stability.

Rising oil prices are likely to increase fuel costs, thereby exacerbating inflationary concerns for both consumers and central banks, which further enhances gold’s role as a hedge against economic volatility and inflation.

Gold surpasses the euro as a reserve asset in 2024

Gold’s ascension to the position of the world’s second-largest reserve asset in 2024, overtaking the euro, marks a significant shift in the landscape of global finance. The most recent data highlights that the U.S. dollar retains its leading position with a 46% share in global reserves, followed by gold at 20% and the euro at 16%.

This transition aligns with a long-standing trend of central banks diversifying their reserves away from conventional currencies in light of geopolitical threats and worries regarding the manipulation of the dollar.

Central banks have been consistent net purchasers of gold for the last three years, with yearly acquisitions surpassing 1,000 tonnes—twice the rate seen in the previous decade. As demand is anticipated to persist, it reinforces the bullish outlook for gold, prompting noted investors like Peter Schiff to weigh in:

“Gold is nearing a new record, but the $GDX is already at its highest level since September 2012. The fact that gold mining stocks are outpacing the metal indicates that this gold bull market is accelerating, as shown by the recent surge in silver. Are you invested in gold?”

Gold’s robust performance in 2025 solidifies its status as a preferred safe-haven asset, nearing all-time price records and affirming its newfound role as the second-largest reserve asset globally. Meanwhile, although Bitcoin remains stable, it has yet to surpass gold’s position as the ultimate safeguard during uncertain times.

Post Comment