Bitcoin Might Reach $210K This Year, Says Research Chief

Reasons to Trust

Editorial guidelines that prioritize accuracy, relevance, and fairness

Developed by industry professionals and thoroughly vetted

Commitment to the highest standards in journalism and publishing

Editorial guidelines that prioritize accuracy, relevance, and fairness

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A leading quantitative trading firm has forecasted that Bitcoin could reach a record high of $210,000 by the year’s end. This bold prediction was expressed by Peter Chung, the firm’s Head of Research, during an interview on April 28.

Market Trends and Institutional Investment Boost Optimism

The optimistic price projection is driven by increasing purchases from major institutional investors and a rise in global liquidity. Chung believes these elements will propel Bitcoin’s value to unprecedented levels.

While Bitcoin has faced challenges, these corrections were necessary steps towards broader adoption, according to Chung. He likens Bitcoin to a double-edged sword: it serves as a high-risk asset in bullish conditions but transforms into a “digital gold” during economic downturns.

Bitcoin’s Performance Under Economic Strain

Chung has pointed out Bitcoin’s historical response during crises. Events such as the Russia-Ukraine conflict in 2022, the collapse of Silicon Valley Bank in 2023, and recent market volatility have tested Bitcoin’s reputation as either a risky asset or a safe haven.

Although Bitcoin did not surge like gold during recent market anxieties, Chung anticipates that it will “catch up” and potentially exceed expectations by year-end. Such behavior during global challenges is rare yet highlights Bitcoin’s evolving role within the financial landscape.

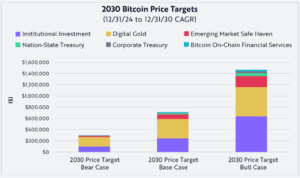

MVRV Ratio Analysis Indicates $210,000 Target

The forecast of $210,000 isn’t arbitrary. Chung previously presented this target in January, referencing a key metric known as the Market Value to Realized Value (MVRV) ratio. This ratio assesses Bitcoin’s current market value against the average price of coins that have been transacted.

Using historical patterns and a 3.5x multiple, Presto estimated Bitcoin’s realized value for 2025 to substantiate their price target. Analysts commonly use this ratio to identify market fluctuations and potential inflection points.

Moreover, observing the increased activity from “whales”—significant cryptocurrency holders—is seen as a signal of strong market confidence. These major investors continue to acquire Bitcoin despite current prices, with some predicting that this trend could escalate Bitcoin’s value even further, potentially reaching $300,000 to $500,000.

Market Predictions from Other Experts

It’s clear that the expectations surrounding Bitcoin’s ascent to six figures are not confined to Presto. Robert Kiyosaki, well-known for his book “Rich Dad Poor Dad,” has also predicted that Bitcoin could hit between $180,000 to $200,000 by 2025.

Looking further into the future, Kiyosaki envisions Bitcoin could touch $1 million by 2035.

While these optimistic forecasts reflect a robust belief in the cryptocurrency market, it’s essential to recognize that cryptocurrencies remain subject to extreme volatility, no matter how compelling the analysis or trends may be.

Post Comment