Major Victory for Ethereum as BlackRock Digitizes $150 Billion Treasury Fund

“Ethereum has achieved a significant victory,” remarked former developer Eric Connor on X on April 30.

This statement was in response to a recent prospectus submitted to the US Securities and Exchange Commission by BlackRock on April 28, which intends to tokenize its $150 billion Treasury Trust market fund through a new asset class known as “DLT Shares.”

Connor highlighted that this represents the “largest influx of real-world assets into Ethereum to date.”

Ethereum has achieved a significant victory.

BlackRock has filed to tokenize its $150 billion Treasury Trust money-market fund with a new “DLT Shares” class.

BNY Mellon will maintain a blockchain record of each share on-chain.

This is the largest real-world asset influx into Ethereum so far.

— Eric Connor (@econoar) April 30, 2025

Ethereum as the Standard for Real-World Assets

The BlackRock Treasury Trust Fund operates as a money market fund focusing exclusively on short-term US Treasury securities. Its goal is to generate income while maintaining liquidity and preserving the principal investment. The fund features low fees and aims for very stable, low-risk returns.

The new DLT shares for the Treasury Trust Fund will leverage blockchain to manage ownership records through BNY Mellon.

Previously, BlackRock introduced the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on the Ethereum blockchain alongside Securitize, facilitating yield generation for qualified investors via tokenized US Treasury securities.

According to Leon Waidmann, the head of research at Onchain Foundation, 93% of BlackRock’s BUIDL is on Ethereum, with the fund currently managing assets totaling $2.34 billion on that blockchain, as noted by rwa.xyz.

“Institutions seek deep liquidity, credible neutrality, and proven security,” Waidmann mentioned, further noting, “ETH already serves as their settlement layer.”

“BlackRock is investing in Ethereum, betting on ETH as the predominant ecosystem,” said the researcher known as “CryptoGoos,” who argued that the value of Ethereum is “immensely undervalued.”

BlackRock is investing in Ethereum.

They’re placing their bets on $ETH as the leading ecosystem.

Don’t be misled.

Ethereum is significantly undervalued. pic.twitter.com/dubhrzqxk4

— CryptoGoos (@crypto_goos) April 29, 2025

BlackRock appears committed to the future of tokenization. “Tokenization will transform investing,” stated CEO Larry Fink in March.

“Markets won’t have to close. Transactions that take days now could be completed in seconds. Billions of dollars currently held up by settlement delays could be immediately reinvested back into the economy, fostering greater growth,” he added.

As the prevailing industry standard for the tokenization of real-world assets (RWA), Ethereum boasts a market share of 56% and has $6.2 billion tokenized on-chain (not including stablecoins), as reported by rwa.xyz.

Challenges for ETH Prices

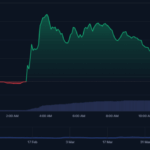

Despite the positive underlying developments, ETH prices continue to hover at bear market lows. The asset has not managed to surpass $1,800 in the past week and remains at levels not seen since September 2023.

Currently, ETH is down 63% from its 2021 peak and has fallen nearly 50% since the start of the year, yet analysts and supporters remain optimistic about its potential to reach five-figure prices shortly.

However, there are signs that institutions are beginning to embrace lower-priced Ether, as evidenced by BlackRock’s spot ETH ETF (ETHA), which has acquired $162 million in ETH over the last four trading days.

Binance Free $600 (Exclusive): Sign up using this link to create a new account and claim a $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER available to readers: Use this link to register and open a $500 FREE position on any coin!

Post Comment