Bitcoin May Experience Weekend Surge to $100K: Is a New All-Time High on the Horizon?

Reasons for Confidence

A rigorous editorial standard prioritizing precision, relevance, and neutrality.

Developed by field specialists and carefully vetted.

Adhering to the highest integrity in reporting and publishing.

A rigorous editorial standard prioritizing precision, relevance, and neutrality.

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

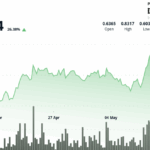

As Bitcoin (BTC) strives to surpass its weekly trading range, it targets the significant resistance level between $99,000 and $100,000, boosting optimism among traders. Various experts predict that the next surge toward a historic high (ATH) could occur soon, potentially within the following days.

Additional Insights

Could Bitcoin Reach $100,000 This Weekend?

In recent weeks, Bitcoin has rebounded from its decline below the $80,000 threshold, moving past the $90,000 milestone and re-establishing itself at the $93,500 resistance point to re-enter its price territory after the US elections.

During this recovery, the digital currency has oscillated within the $93,000-$96,000 range, remaining stable over the past weeks. A month-beginning surge has allowed BTC to escape this confined space, mirroring its movement from two weeks prior.

Market analyst Daan Crypto Trades noted that during the mid-April recovery, BTC moved to the $83,000-$86,000 range and remained consolidated for over a week before a minor 2% rise to the $87,500 resistance. This was followed by a brief period of stability before breaking out into a higher range.

He suggested that Bitcoin reflects “similar conditions as observed during the previous week” as it has remained within the $93,000-$96,000 bandwidth and made a 2% leap to the $97,700 level.

Furthermore, the largest cryptocurrency by market cap has entered a “tight range” pattern, fluctuating between $97,050 and $97,700 for several hours.

If BTC continues its recent pattern, the primary cryptocurrency may rise by approximately 8% by the end of the weekend and could revisit the $99,000-$100,000 range in the near future.

BTC Mirrors Q4 2024 Trading Behavior

On another note, analyst Rekt Capital pointed out that Bitcoin might replicate its performance from Q4 2024. He observed that BTC has rebounded from a downward deviation, reclaiming its recent accumulation zone, although it faces resistance at a lower high in this area.

Previously, the cryptocurrency encountered a similar predicament within the post-halving accumulation range, initially being thwarted at the lower high before retracting to the lows of that range. Subsequently, Bitcoin surpassed the lower high resistance, retraced it as support, and eventually surged to a new ATH.

The analyst mentioned that this concept was initially posited ahead of the US election rally, implying that BTC could replicate its Q1 2024 surge, likely boosted by proposed US spot Bitcoin Exchange-Traded Funds (ETFs).

“It would be fitting if Bitcoin were to follow history and replicate the same trajectory in this current range,” he remarked.

Nonetheless, Rekt Capital emphasized that for historical trends to persist, Bitcoin must face rejection at the $99,000 level, maintain the $93,500 support, and successfully break through the $97,000-$99,000 range before encountering rejection at the $104,500 resistance.

Additional Insights

Following that, the flagship cryptocurrency needs to sustain the $97,000-$99,000 range as support to potentially enable a breakout to new ATHs.

The analyst concluded that if Bitcoin can consistently hold the $93,500 level, it will be set for movement across its accumulation zone. However, BTC must break through its “black Lower High resistance within this range, which currently sits at approximately $99k.”

At this point, Bitcoin is trading at $97,461, reflecting a 3% increase over the weekly period.

Post Comment