Small Firm Aims to Acquire $20M TRUMP Token to Transform U.S.-Mexico Trade Agreements

Freight Technologies (FRGT), a logistics tech company with a market capitalization of $4.8 million, has announced an arrangement to acquire up to $20 million in the Official Trump Token (TRUMP). This initiative is part of their effort to develop a cryptocurrency treasury aimed at enhancing cross-border trade between the United States and Mexico.

The firm disclosed that it obtained financial support through a convertible note agreement with an institutional investor, with an initial commitment of $1 million already in place. All proceeds from this funding will exclusively be utilized for TRUMP token acquisitions, positioning the company as one of the early publicly traded entities to embrace this strategy.

This initiative follows a distinct investment in AI-tied FET tokens currently priced at $8 million, which the organization states will bolster AI functionalities within its logistics systems.

Investing in digital currencies is an established approach among publicly traded corporations. Michael Saylor popularized this tactic using a bitcoin strategy, inspiring similar actions from companies like Semler Scientific (SMLR). Recently, Cantor (CEP) has also entered the arena with significant funds for similar purposes. Firms such as Sol Strategies (HODL) and Janover (JNVR) are investing in SOL tokens, granting their investors cryptocurrency exposure.

This trend is gaining traction in Japan, where hospitality company Metaplanet has reached 5,000 BTC on its balance sheet and has issued $25 million in bonds for further acquisitions. Other smaller entities, including Value Creation, Remixpoint, NEXON, Anap Holdings, and WEMADE, have also been amassing cryptocurrencies.

Freight’s strategy, however, aims to leverage its influence on the U.S.-Mexico trade negotiations amidst President Trump’s aggressive tariff policies.

Javier Selgas, the CEO of Freight Technologies, remarked, “Acquiring Official Trump tokens is an excellent approach to diversify our crypto treasury and promote equitable, balanced, and unrestricted trade between the U.S. and Mexico.”

While this approach might offer benefits to Freight, the implications of such a monetary strategy in influencing presidential policy via a meme coin raise questions about potential conflicts of interest. Recently, Trump announced plans to host a private dinner with top token holders, provoking backlash from Democratic lawmakers who cited concerns of the president’s engagement with the token as possible grounds for impeachment.

On April 25, Senator Jon Ossoff highlighted the crypto project’s invitation to top holders for a dinner with Trump, labeling it a blatant case of monetizing access to the presidency.

For Freight, whose stock experienced a nearly 90% decline over the last year and is heavily intertwined with cross-border trading, this may be a pivotal strategy to stabilize share prices.

“Central to Fr8Tech’s vision is fostering active and productive trade between the U.S. and Mexico,” Selgas noted. “Mexico ranks as the leading trading partner for the U.S., being the largest destination for U.S. exports as well as the primary source of U.S. imports.”

Following the announcement of the acquisition, Freight Technologies’ shares surged by over 111% before the market closed on Friday. However, during after-hours trading, the stock dropped by 21.6%.

Freight Technologies offers various applications, including cross-border freight booking and transportation management, aimed at modernizing the distribution of goods throughout North America.

In a related development, other companies have increased their stakes in the cryptocurrency realm linked to the U.S. President. Last month, DWF Labs invested $25 million into World Liberty Financial (WLFI), a decentralized financial protocol associated with Trump and his family, as it seeks to establish a presence in the United States.

This investment grants DWF Labs a governance role in the initiative, which has been collecting diverse cryptocurrencies and is set to launch a stablecoin backed by short-term U.S. Treasury bills and other cash equivalents named USD1.

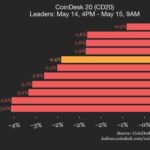

Currently, TRUMP tokens are priced at $12.7, reflecting a daily increase of 0.1% and a 42% rise over the past month.

Post Comment